Beyond the Digital Ledger: Why Precious Metal Coins Are My New Favorite Portfolio Diversifier

Feeling a bit over-indexed in the digital world? I was too. Let's talk about something tangible, historical, and surprisingly strategic: using precious metal coins to diversify your personal finances.

Let’s be honest for a second. How often do you check your investment portfolio? Once a day? Once an hour? In our hyper-connected world, it’s easy to get caught up in the dizzying dance of stock tickers and crypto charts, where fortunes seem to be made and lost in the blink of an eye. For a long time, that was my entire financial world—a series of numbers on a screen. But recently, I’ve felt a growing pull toward something more… real. Something tangible. And that’s what led me down the fascinating rabbit hole of precious metal coins.

I’m not talking about dusty old pennies in a jar. I’m talking about a deliberate strategy to diversify my assets, to build a financial foundation that isn’t entirely dependent on the whims of the market or the stability of a single currency. It started as a curiosity, a sort of romantic notion of holding gold. But the more I researched, the more I realized that incorporating precious metals, specifically government-minted coins, into a modern portfolio is one of the oldest and most respected diversification strategies in the book. It felt like uncovering a secret that’s been hiding in plain sight.

It’s a way of grounding a portfolio in something with intrinsic, historical value. In an age of digital abstraction, the simple, solid weight of a silver or gold coin in your hand feels like an anchor. It’s a quiet rebellion against the idea that all value must be virtual, and honestly, it has brought a surprising sense of security to my financial planning.

The Real "Why": Hedging Against a World of Uncertainty

So, why would anyone in the 21st century bother with something as old-fashioned as gold coins? The answer is surprisingly simple: because the world is, and always has been, uncertain. Economic cycles, inflation, geopolitical turmoil—these aren't new concepts. Throughout history, during times of crisis, people have consistently turned to precious metals as a store of value. When paper currencies lose their purchasing power (ahem, inflation), gold and silver have historically held their ground. They are the ultimate hedge.

Think of it this way: most of our investments—stocks, bonds, even cash in the bank—are part of the same complex financial system. They are, in essence, promises. A stock is a promise of a share in a company's future profits. A dollar bill is a promise from the government. But a gold coin? It’s not a promise of value; it is value. It has no counterparty risk. Its worth isn't dependent on a CEO's performance or a government's fiscal policy. This independence is what makes it such a powerful tool for diversification. When one part of your portfolio zigs (like the stock market taking a nosedive), precious metals often zag.

I read a report recently that analyzed portfolio performance over several decades, and the conclusion was clear: a small allocation to gold (typically 5-10%) can reduce overall portfolio volatility and improve returns over the long run. It acts as a kind of insurance policy. You hope you never need it, but you’ll be incredibly glad you have it when the unexpected happens. It’s about playing the long game, protecting the wealth you’ve worked so hard to build.

Bullion vs. Numismatics: A Beginner's Guide to Buying Coins

Once I was sold on the "why," the "what" became the next big question. The world of coins can seem intimidating, filled with jargon and passionate collectors. But for investment purposes, it boils down to a key distinction: bullion coins versus numismatic (collectible) coins. Understanding this difference is the single most important step for a new investor.

Bullion coins are the workhorses of precious metal investing. Their value is tied directly to the spot price of the metal they contain, plus a small premium to cover the cost of minting and distribution. Think of iconic, globally recognized coins like the American Gold Eagle, the Canadian Maple Leaf, or the American Silver Eagle. These are produced by government mints, their weight and purity are guaranteed, and they are incredibly liquid—meaning they’re easy to buy and sell anywhere in the world. For someone looking to diversify, bullion is almost always the right place to start. You're buying the metal, not a story.

Numismatic coins, on the other hand, are a different beast entirely. Their value comes from rarity, historical significance, condition, and collector demand, often far exceeding their actual metal content. While the potential for appreciation can be massive, it’s a specialized market that requires deep knowledge. It’s more akin to investing in fine art than in a commodity. For most of us, the complexity and higher premiums make it a riskier proposition. My advice? Stick to the bullion. It’s straightforward, transparent, and perfectly serves the purpose of adding a solid, metal-based asset to your portfolio.

The Practical Side: How to Buy and Where to Keep It

Alright, let's get down to brass tacks—or, well, gold and silver. How do you actually acquire these coins and ensure they're safe? The process is more accessible than you might think. The most common route is through reputable online dealers. Websites like APMEX, JM Bullion, and SD Bullion are major players in the US. They offer a huge selection, transparent pricing that tracks the spot market, and insured shipping directly to your door. The key is to stick with the big, well-reviewed names to avoid counterfeits or shady practices.

Another great option is your local coin shop. Building a relationship with a local dealer can be invaluable. They can offer guidance, test coins for you, and may even offer better prices on certain items, especially if you’re a repeat customer. Just be sure to compare their premiums (the amount they charge over the spot price) with online dealers to make sure you’re getting a fair deal. A high premium can eat into your investment, so it pays to shop around.

Once you have your coins, storage is the next critical decision. The most straightforward option is a high-quality home safe, preferably one that is bolted to the floor and is both fireproof and waterproof. This gives you direct control and access. However, it also puts the responsibility for security squarely on your shoulders. For larger holdings, many investors opt for a third-party depository. These are ultra-secure, insured vaults that specialize in storing precious metals. You own the specific coins (allocated storage), but they handle the security. It’s a trade-off between access and peace of mind, and the right choice depends entirely on your personal comfort level and the size of your investment.

A Final, Grounded Thought

Stepping into the world of precious metals has fundamentally shifted how I view my personal finances. It’s not about abandoning modern investments or preparing for the apocalypse. It’s about balance. It’s about acknowledging that in a system built on digital promises, there is a profound and strategic power in owning something real, something that has been a universal symbol of wealth for thousands of years.

Adding gold and silver coins to my portfolio has been a lesson in patience and long-term perspective. They don’t pay dividends, and their value can fluctuate. But they sit quietly, a physical anchor in a sea of volatility, offering a unique kind of financial peace. As you build your own financial future, perhaps it’s worth considering adding a little bit of that timeless, tangible security to your own ledger.

You might also like

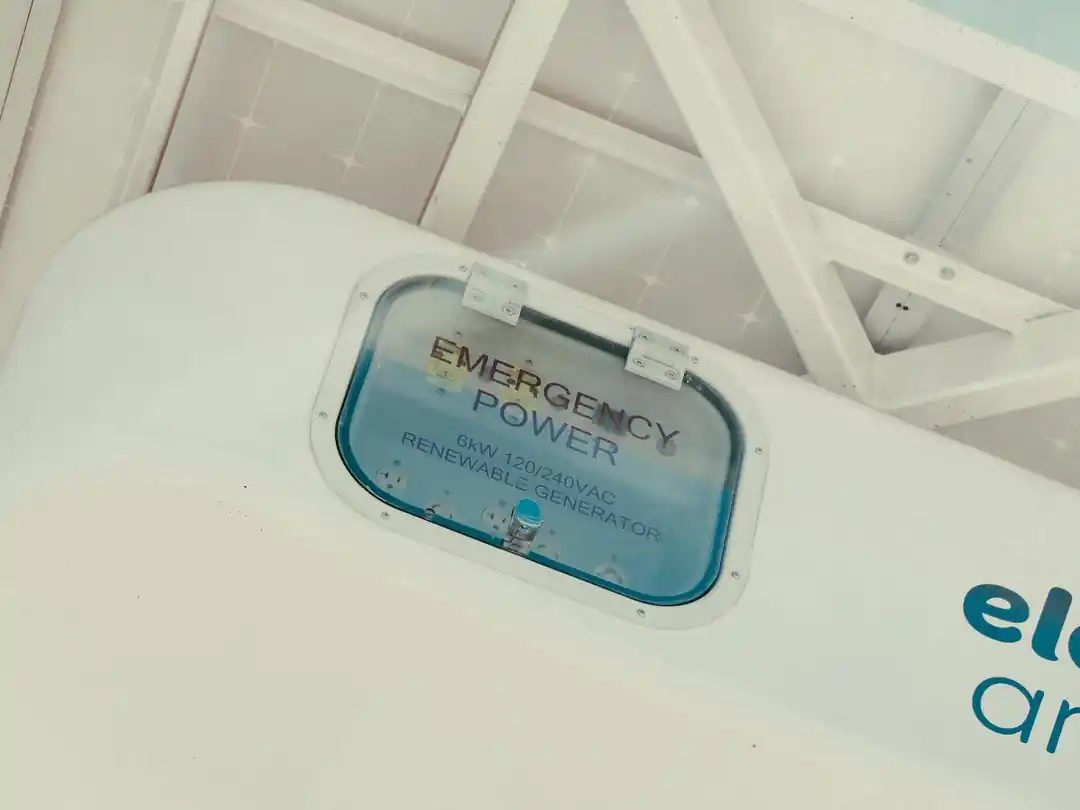

Don't Get Left in the Dark: Your Ultimate Guide to Home Power Backup

Power outages are more than just an inconvenience; they're a modern reality. From silent batteries to powerful generators, let's explore the best ways to keep your home powered up when the grid goes down.

Cathedrals of Sport: The Architectural DNA of the Modern Stadium

Ever wonder what goes into building the colossal stadiums of today? It's more than just seats and a field. We're diving into the architectural marvels that make modern venues a world away from the bleachers of the past.

Don't Just See Cairo, Ride It: A Tourist's Guide to Public Transport

Feeling intimidated by Cairo's famous traffic? Don't be. Diving into the city's public transport is the secret to unlocking its true, vibrant heart.

Sailing Through History: How to Choose the Perfect Nile Cruise From Luxor to Aswan

Dreaming of Egypt? A Nile cruise is the ultimate way to experience its ancient wonders. Let's break down how to pick the right boat, itinerary, and all the little details for your trip of a lifetime.

The Overlooked Gold: Why Investing in Water Is a Deeper Play Than You Think

It doesn't have the flash of AI or biotech, but water is quietly becoming one of the most critical investment sectors. Here's why you should be paying attention.