The Ultimate Beginner's Guide to Airline Loyalty Programs

Ever feel like you're the only one paying full price for flights? Let's pull back the curtain on airline loyalty programs and get you started on the path to earning miles and traveling smarter.

Have you ever been scrolling through Instagram, seen a friend on what looks like their third European vacation of the year, and thought to yourself, how on earth do they afford that? I get it. For a long time, I believed that frequent travel was a luxury reserved for the ultra-wealthy or those who lived out of a suitcase for work. The whole world of "points," "miles," and "status" felt like a complicated, exclusive club I wasn't invited to.

Honestly, the turning point for me was realizing that I was leaving money on the table. Or, more accurately, I was leaving travel on the table. Every flight I took, every dollar I spent could have been earning me a currency that translates directly into future trips. Airline loyalty programs aren't just for the business-class road warriors anymore. They're for anyone who wants to make their travel dreams a little more attainable.

Think of it as a simple thank-you note from the airline. You choose to fly with them, and they reward you for that loyalty. But the real secret, the one that blew my mind, is that flying is often just the tip of the iceberg when it comes to earning. Today, we're going to demystify this world together. No confusing jargon, no gatekeeping. Just a straightforward guide to getting started, so you can stop wondering and start earning.

What Exactly Are We Talking About? Miles, Points, and Status

At its core, an airline loyalty program is a pretty simple concept. When you join a program (which is almost always free), you start earning a form of currency—usually called "miles" or "points"—for certain activities. The most obvious one is flying. You buy a ticket, take a flight, and the airline deposits a certain number of miles into your account. It's a straightforward exchange for your business.

For a long time, programs awarded miles based on the distance you flew. A flight from New York to Los Angeles would earn you more miles than a short hop from Dallas to Houston. However, most major U.S. airlines, like Delta, United, and American, have shifted to a revenue-based model. This means the number of miles you earn is tied directly to how much you paid for your ticket (minus taxes and fees). The more expensive the ticket, the more miles you rack up. It’s a system that tends to reward big spenders.

But miles are only one half of the equation. The other, more coveted, part is "elite status." This is where the real VIP treatment kicks in. You achieve status by flying a certain amount or spending a certain amount with an airline in a calendar year. Each airline has different tiers (think Silver, Gold, Platinum), and as you climb the ladder, the perks get better. We're talking free checked bags, priority boarding (so you can snag that overhead bin space), complimentary upgrades to first class, and even access to swanky airport lounges. For a beginner, elite status might seem far off, but it's good to know it's the ultimate goal of the loyalty game.

Choosing Your Team: Alliances and Hubs

Okay, so you're ready to sign up. But for which airline? This can feel like a huge decision, but a little logic goes a long way. The first thing to consider is where you live. If you're in Atlanta, a massive hub for Delta, it probably makes sense to focus on their SkyMiles program. If you're based in Denver, a United hub, MileagePlus is likely your best bet. Aligning with the dominant airline at your home airport just makes logistical sense—you'll have more flight options and more opportunities to earn.

The second piece of the puzzle is understanding the three major global airline alliances: Star Alliance (led by United in the U.S.), Oneworld (led by American Airlines), and SkyTeam (led by Delta). Think of these as massive teams of airlines that have agreed to cooperate. This is a huge advantage because it means you can earn miles on your primary airline's program even when you're flying on one of their partners. For example, you can earn United miles while flying on Lufthansa to Germany or use your American Airlines miles to book a flight on British Airways to London.

This alliance network dramatically expands your options for both earning and redeeming miles, especially for international travel. It allows you to consolidate your efforts into one main account instead of having a few thousand useless miles scattered across a dozen different airlines. So, before you commit, take a look at which airlines fly the routes you're most interested in and which alliance they belong to. This strategic choice will pay dividends down the road.

The Real Secret: Earning Miles Without Flying

Here’s the part that changes everything. For many of us, the fastest way to earn a free flight has absolutely nothing to do with getting on a plane. The single most powerful tool in your mileage-earning arsenal is an airline co-branded credit card. These cards are famous for their generous sign-up bonuses, which can instantly give you 50,000, 75,000, or even more miles after you meet a minimum spending requirement in the first few months. That bonus alone can often be enough for a round-trip ticket within the U.S. or even a one-way trip to Europe.

Beyond that initial boost, these cards turn your everyday spending into a mile-generating machine. You’ll earn miles on every purchase, with many cards offering bonus miles for specific categories like dining, groceries, or gas. I started by putting all my regular, budgeted expenses (things I was going to buy anyway) on my new card and paying it off in full every month. It was amazing how quickly the miles started to add up. The key, and I can't stress this enough, is to treat it like a debit card and never carry a balance. The interest charges would quickly wipe out the value of any rewards you earn.

But it doesn't stop with credit cards. Most airlines have online shopping portals that are incredibly easy to use. Instead of going directly to, say, Nike.com, you first log into your airline's shopping portal, click their link to the Nike site, and you'll earn a certain number of miles per dollar on your purchase, on top of the miles you earn from your credit card. They also have dining programs where you link your credit card and automatically earn miles at thousands of participating restaurants. It’s about creating layers of earning on the spending you already do.

Putting Your Miles to Work: The Art of Redemption

Earning miles is fun, but spending them is even better. The most obvious use is for an "award flight." You search for a flight on the airline's website, but instead of paying with cash, you select "Pay with Miles." It's a beautifully simple process. However, be aware that the number of miles you need can change based on demand, a practice called "dynamic pricing." This means that flying during the off-season or on a Tuesday instead of a Friday can save you a significant number of miles.

While redeeming for an economy ticket is a great way to save money, many travel enthusiasts will tell you the absolute best value comes from booking business or first-class seats, especially on long international flights. A lie-flat seat to Asia might cost $8,000 in cash but could be available for 120,000 miles. That's a redemption value of over 6 cents per mile, which is phenomenal. It’s a way to experience a level of luxury that most of us would never pay for out of pocket.

You'll often see options to use miles for things other than flights, like hotel stays, rental cars, merchandise, or gift cards. My advice? Steer clear. While it might seem tempting to cash in your miles for a new toaster, the value you get is almost always significantly lower than what you'd get by redeeming for a flight. Protect your hard-earned miles and save them for what they do best: getting you from point A to point B in style and for a fraction of the cost. The world is waiting.

You might also like

Physical Silver vs. Silver ETFs: Which Is the Right Investment for You?

Thinking about investing in silver? We're breaking down the classic dilemma: holding tangible silver bars versus the digital ease of a silver ETF. Let's explore the pros and cons.

Your Guide to Riding Laredo's El Metro Like a Local

Thinking about hopping on the bus in Laredo? It's a fantastic way to get around the city. Let's break down everything from fares to routes to make your first ride a total breeze.

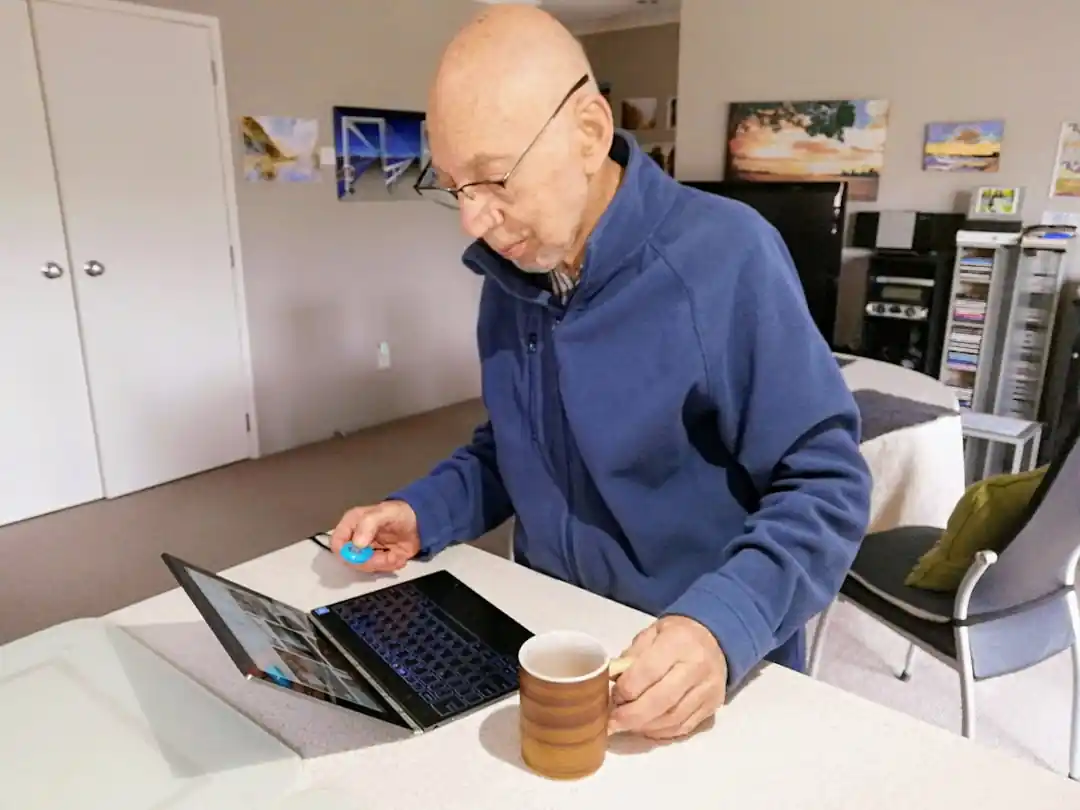

Your Golden Years, Your Golden Expertise: Starting a Consulting Business After Retirement

Retirement doesn't have to mean stepping away from meaningful work. It can be the perfect time to leverage decades of experience into a flexible, fulfilling consulting venture, on your own terms.

Don't Let Parking Ruin Your Liberty Bell Trip: A Guide to Finding a Spot

Planning a trip to see the iconic Liberty Bell? Navigating Philadelphia's historic district by car can be tricky. Here’s our guide to the best parking strategies.

The Stock Market Isn't the Economy: Untangling the Ticker from the Truth

We're often told that a rising stock market means a healthy economy, but is that the whole story? Let's take a closer look at the complicated relationship between Wall Street and Main Street.