Don't Just Buy Crypto, Budget for It: A Practical Guide

Heard the crypto hype? Before you jump in, let's talk about how to weave digital assets into your budget without losing your shirt. It's easier than you think.

Let's be honest, you can't scroll through your social media feed or turn on the news without hearing about cryptocurrency. Bitcoin, Ethereum, Dogecoin—it feels like a digital gold rush, and the temptation to jump in is real. I get it. You see stories of people making incredible gains, and that little voice in your head starts whispering, "What if that could be me?" It’s a powerful feeling, a mix of curiosity and classic FOMO (fear of missing out).

But here’s a truth that gets lost in the hype: diving into crypto without a plan is less like investing and more like gambling. I learned this the hard way a few years ago, throwing a bit of money at a coin I’d heard about, only to watch it plummet a week later. It wasn't a devastating loss, but it was a sharp lesson. The most successful people in this space aren't just lucky; they're strategic. They treat crypto as a serious, albeit high-risk, component of a well-thought-out financial plan.

So, before you download that trading app, let's take a breath. Let's talk about how to approach cryptocurrency with the mind of a savvy investor, not a lottery player. It all starts with something that sounds boring but is actually your secret weapon: your personal budget. By figuring out exactly where crypto fits into your financial life, you can explore this exciting new world without risking your financial stability.

The Golden Rule: Your Finances Come First

Before a single dollar goes into crypto, we need to do a quick financial health check. Think of it as building the launchpad before you send up the rocket. If the foundation is shaky, the whole mission is at risk. This is the stuff financial advisors always talk about, and for good reason. It’s the bedrock of responsible money management.

First, and this is non-negotiable, you need an emergency fund. This is your buffer against life's unexpected curveballs—a car repair, a medical bill, a sudden job loss. The standard advice is to have three to six months' worth of essential living expenses saved in an easily accessible, high-yield savings account. This fund ensures that if something goes wrong, you won't be forced to sell your investments (crypto or otherwise) at a terrible time just to cover costs.

Second, take a hard look at high-interest debt. I'm talking about credit card balances. The double-digit interest rates on most credit cards are a guaranteed loss that will almost certainly cancel out any potential gains you might make in a volatile market like crypto. It makes zero sense to invest in a high-risk asset while a high-interest debt is actively draining your wealth. Pay it down. Once your emergency fund is solid and your high-interest debt is under control, you can start thinking about investing.

Finding Your "Crypto Number": How Much Is Too Much?

Okay, so your financial house is in order. Now for the big question: how much should you actually invest in crypto? The answer is deeply personal, but a great starting point is to only use what financial experts call "speculative capital." In plain English, it’s money you can afford to lose. I know that sounds dramatic, but the volatility of cryptocurrency is no joke. Prices can swing wildly, and you have to be mentally and financially prepared for the possibility of a total loss.

A fantastic framework for this is the 50/30/20 budget. 50% of your take-home pay goes to "Needs" (housing, utilities, groceries), 30% goes to "Wants" (dining out, hobbies, entertainment), and 20% goes to "Savings & Investments." Your crypto allocation should come from a small slice of that 20% category. For most beginners, a good rule of thumb is to allocate no more than 1% to 5% of their total investment portfolio to high-risk assets like crypto.

So, if you have $10,000 in a traditional investment portfolio (like stocks and bonds), you might consider starting with just $100 to $500 in crypto. This approach allows you to get your feet wet, learn how the market works, and experience the ups and downs without putting your long-term financial goals in jeopardy. You can always increase your allocation as you become more comfortable and knowledgeable.

Smart Strategies for Investing on a Budget

Once you have your number, the next step is deciding how to invest it. Just throwing the whole amount in at once (lump-sum investing) can be risky. What if you buy at a peak right before a market dip? A much more beginner-friendly and budget-conscious strategy is Dollar-Cost Averaging (DCA).

Dollar-Cost Averaging is simple: you invest a fixed amount of money at regular intervals, no matter what the price is. For example, you could decide to buy $25 worth of Bitcoin every Friday. When the price is high, your $25 buys a little less. When the price is low, it buys a little more. Over time, this averages out your cost per coin and smooths out the bumps of market volatility. It takes the emotion and guesswork out of trying to "time the market," which is a game even the pros rarely win.

Another key strategy is to stick with the "blue chips" of the crypto world, at least at first. Bitcoin (BTC) and Ethereum (ETH) are the two largest and most established cryptocurrencies. They have the longest track records and the most widespread adoption, making them a more stable foundation for a new portfolio compared to smaller, more speculative "altcoins." You can explore those later, but building a base with the market leaders is a prudent first step.

Track Everything and Stay the Course

Finally, integrating crypto into your budget means tracking it diligently. Whether you use a spreadsheet or a budgeting app, create a separate category for your crypto investments. This helps you see exactly how much you're allocating and holds you accountable to the limits you set for yourself. It also allows you to monitor your performance over time without getting caught up in the daily noise.

Remember that investing in a volatile asset is a mental game as much as it is a financial one. The market will have incredible upswings and gut-wrenching downturns. By setting a clear budget, using a disciplined strategy like DCA, and focusing on the long-term potential of established projects, you can navigate the chaos with confidence.

The world of cryptocurrency is fascinating and full of potential. By approaching it with a thoughtful, budget-first mindset, you give yourself the best chance to participate in its growth responsibly. You don’t need to bet the farm to be an investor; you just need a plan. Your future self will thank you for it.

You might also like

Ditching the Rental Car: Can You Really Explore Phoenix and Tucson on Public Transit?

Thinking of visiting Arizona's two largest cities? We dive into whether you can realistically skip the rental car and navigate Phoenix and Tucson using only public transportation.

That Iconic Maldives Seaplane Flight: Here’s What to Really Expect

It’s on every travel bucket list, but what’s the Maldives seaplane experience actually like? From baggage rules to those unbelievable views, here’s the real story.

From Windfall to Wealth: A Human-Centered Guide to Investing Your Truck Accident Settlement

Receiving a large settlement is more than a financial event; it's a life-altering moment. Here’s how to navigate the complexities with intention and build a future of lasting security.

Physical Silver vs. Silver ETFs: Which Shines Brighter for Your Portfolio?

Navigating the world of silver investment can feel a bit like choosing between a tangible treasure chest and a digital vault. Let's unpack the pros and cons of holding physical silver versus investing in silver ETFs.

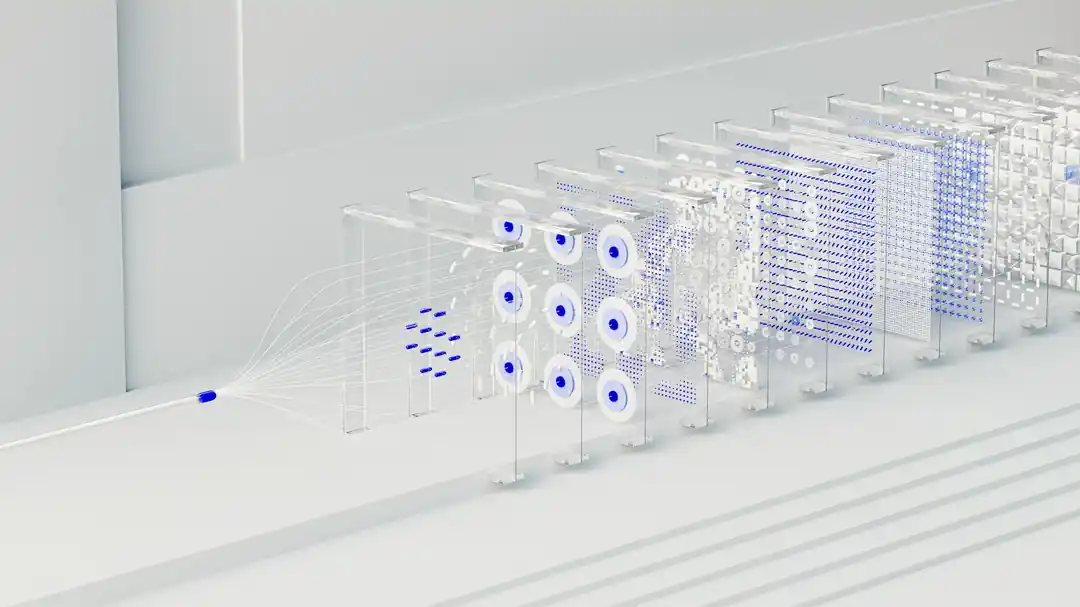

From Sensor to Insight: How AWS Makes the Internet of Things Possible

Ever wonder how all those smart gadgets actually work together? It’s not magic. A lot of the time, it’s the powerful, behind-the-scenes work of platforms like Amazon Web Services (AWS) that turns a simple device into a smart one.