The Entrepreneur's Roadmap: A Guide to Applying for a Small Business Loan from a Bank

The idea of applying for a bank loan can be daunting, but it doesn't have to be. Let's walk through the process of securing the funding your small business needs to thrive.

There’s a unique kind of thrill that comes with running your own business. It’s a path paved with passion, late nights, and the incredible satisfaction of building something from the ground up. But almost every entrepreneur reaches a point where passion alone isn't enough to get to the next level. You need capital. The thought of walking into a bank to ask for a small business loan can feel incredibly intimidating, like you’re about to be judged on every decision you’ve ever made. I’ve been there, and the anxiety is real.

Honestly, the process can seem like a black box. You pour your heart into gathering documents, fill out endless forms, and then wait, hoping for the best. But what I’ve learned is that with the right preparation and a clear understanding of what the bank is looking for, it’s far from an impossible task. It’s less about luck and more about strategy. Think of it not as asking for a handout, but as presenting a compelling business case to a potential partner who wants to see you succeed—because your success is their success.

This guide is the conversation I wish I’d had when I was starting out. It’s a roadmap to demystify the process, helping you walk into that bank with confidence, fully prepared to get the "yes" you and your business deserve.

Before You Even Speak to a Banker: Laying the Foundation

The most critical work of securing a loan happens long before you schedule a meeting. This is the preparation phase, where you gather your story and your evidence. Banks are, by nature, risk-averse. Your job is to provide them with a complete, coherent, and convincing package that minimizes their perceived risk. This starts with a crystal-clear understanding of exactly why you need the money and how much you need. Is it for new equipment? Expanding to a new location? Or maybe to manage cash flow during a slow season? Be specific. A vague request for "money to grow" won't cut it.

Next, you need to assemble your financial arsenal. This means getting your documents in pristine order. At a minimum, you'll need several years of personal and business tax returns, up-to-date financial statements (your profit and loss statement, balance sheet, and cash flow statement), and business bank statements. These documents are the language the bank speaks. They tell the story of your financial health, your reliability, and your ability to generate the revenue needed to pay back the loan.

Finally, and perhaps most importantly, you need a rock-solid business plan. This is your narrative. It should detail your business model, your target market, your competitive analysis, and your marketing strategy. Crucially, it must include detailed financial projections that show how the loan will help you generate more revenue. A well-researched and thoughtfully written business plan shows the lender that you’re not just a dreamer; you’re a planner and a strategist.

Choosing Your Partner: Finding the Right Bank and Loan

Not all banks are created equal, especially when it comes to small business lending. The giant national bank on the corner might be convenient, but a smaller community bank or a local credit union might have a greater appetite for lending to local businesses and a better understanding of your market. It pays to shop around. Don't just look at interest rates; consider the relationship. A good business banker can be an invaluable advisor for years to come.

You also need to understand the different types of loans available. A term loan provides a lump sum of cash upfront that you pay back over a set period. This is great for large, one-time purchases like real estate or major equipment. A business line of credit, on the other hand, works more like a credit card, giving you access to a pool of funds that you can draw from as needed. This is ideal for managing cash flow, purchasing inventory, or handling unexpected expenses.

Then there are SBA loans. These aren't loans from the Small Business Administration itself, but rather loans from traditional banks that are partially guaranteed by the SBA. This guarantee reduces the bank's risk, making them more willing to lend to businesses that might not meet their standard criteria. SBA loans often come with favorable terms and lower down payments, but they also require a mountain of paperwork and a longer application process. Do your research to figure out which product is the best fit for your specific needs.

The Application and Beyond: Making Your Case

Once you’ve done your homework and chosen a lender, it’s time to formally apply. Be prepared for scrutiny. The loan officer will pour over every document you’ve provided. They will analyze your personal and business credit scores, your cash flow, and any collateral you’re offering. They’re looking for red flags, but they’re also looking for reasons to say yes. Your preparedness and professionalism during this stage can make a huge difference. Answer their questions promptly and thoroughly.

If your application is denied, don’t panic. It’s not necessarily the end of the road. Politely ask the lender for the specific reasons for the denial. It could be something you can fix, like a low credit score or insufficient cash flow. Use it as a learning experience. You can work on strengthening your application and try again in the future, or you can explore alternative funding sources like online lenders, microlenders, or even business grants.

But if you get that "yes"—and with the right preparation, you have a great shot—it’s a moment to celebrate. It’s a validation of your hard work and a testament to the strength of your business. That capital is the fuel that can help you hire new employees, launch a new product, or finally move into that perfect location. It’s the next step in your incredible entrepreneurial journey. The path to a bank loan is a marathon, not a sprint, but crossing that finish line can change everything.

You might also like

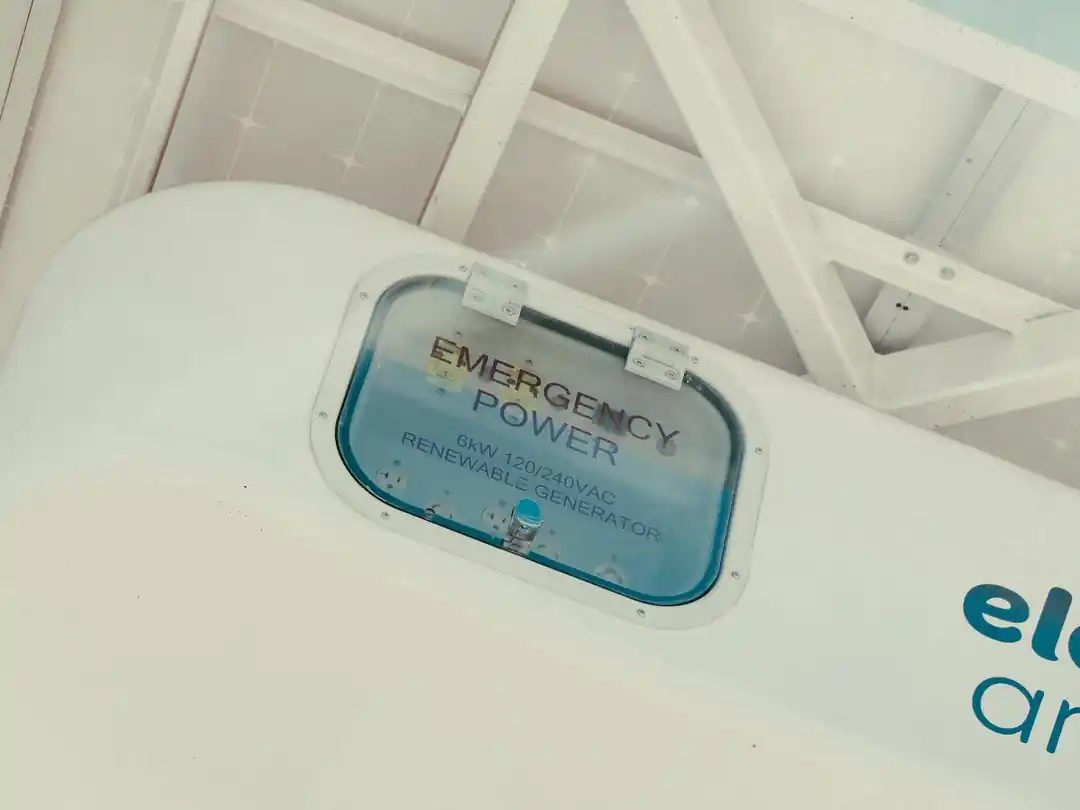

Don't Get Left in the Dark: Your Ultimate Guide to Home Power Backup

Power outages are more than just an inconvenience; they're a modern reality. From silent batteries to powerful generators, let's explore the best ways to keep your home powered up when the grid goes down.

The Secret Season: Why Fall and Spring Are the Best Times for the Northern Lights

Forget the deep freeze. I'm sharing why the equinox months of September and March are statistically the most magical times to chase the aurora borealis.

Crossing Borders: Your Guide to Navigating International Travel Like a Pro

That little flutter of anxiety before you step up to the passport control counter? We've all been there. Let's demystify the process of crossing international borders so you can focus on the adventure.

Your Passport to Paradise: The Ultimate Budget-Friendly Guide to Southeast Asia

Dreaming of an epic adventure that doesn't empty your bank account? Southeast Asia is calling. Here are the top destinations where your dollar goes further than you can imagine.

Beyond the Buzz: A Real-Talk Guide to Fine-Tuning Your Own LLM

Ever feel like off-the-shelf AI doesn't quite get you? Let's pull back the curtain on fine-tuning. It's the secret sauce to making a large language model speak your language, and it's more accessible than you think.