Beyond the Basket: Diversifying Your Investments for a Smoother Ride

Feeling a little exposed in your investment portfolio? Let's chat about how smart diversification can be your best friend in navigating the ups and downs of the market, especially for us US investors.

Hey there, fellow financial adventurers! Have you ever felt that little pang of anxiety when you see the market doing its unpredictable dance? One day, everything's soaring, and the next, it feels like the bottom is falling out. It's a common feeling, especially when you've got your hard-earned money on the line. But what if I told you there's a time-tested strategy, almost like a financial superpower, that can help smooth out those wild rides and protect your investments? It's called diversification, and honestly, it's one of the most crucial concepts for any US investor looking to manage risk and build long-term wealth.

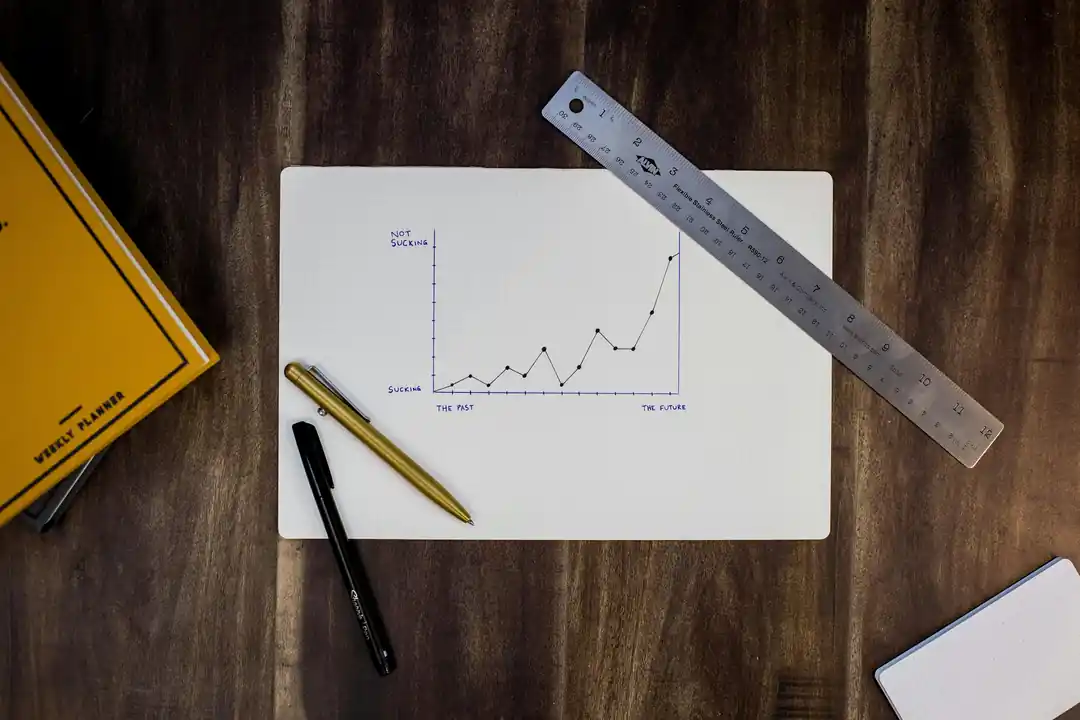

Think of it this way: you wouldn't put all your eggs in one basket, right? Because if that basket tips over, well, you're left with a rather messy situation. The same logic applies to your investments. Diversification is simply the practice of spreading your money across a variety of investments that have different expected risks and returns. The goal isn't necessarily to hit a home run with every single investment, but rather to create a portfolio where the inevitable dips in one area are potentially offset by gains or stability in another. It’s about building a resilient financial foundation that can weather various market conditions.

The Core Idea: Spreading Your Bets Wisely

At its heart, diversification is a risk management strategy. It acknowledges that no single investment is foolproof, and market conditions are constantly shifting. By allocating your capital across different types of assets, you reduce your reliance on any one investment's performance. This approach can significantly mitigate the impact of poor performance from a single stock or sector, enhancing the potential for more stable returns over time. It’s not about eliminating risk entirely – that’s impossible in investing – but about managing it intelligently.

One of the most fundamental ways to diversify is across different asset classes. We're talking about the big categories like stocks (equities), bonds (fixed income), cash and cash equivalents, and even real assets like property or commodities. Each of these behaves differently under various economic conditions. For instance, when stock prices might be falling, bonds could hold steady or even appreciate, providing a crucial cushion against losses in the equity portion of your portfolio. This interplay between different asset classes is a cornerstone of a robust diversification strategy.

Beyond just the broad categories, it's vital to diversify within those asset classes too. For stocks, this means not just buying a bunch of different companies, but ensuring those companies span various industries or sectors. If you're heavily invested in, say, tech stocks, consider adding some biotech, utility, or retail companies to your mix. You should also think about market capitalization – mixing large-cap, mid-cap, and small-cap companies – and even investment styles, balancing growth stocks with value stocks. The same goes for bonds; look for different maturities and issuers, from US government bonds to corporate bonds.

Embracing Modern Portfolio Theory (MPT)

For those who love a bit more structure, the concept of Modern Portfolio Theory (MPT) offers a powerful framework. Developed by Nobel laureate Harry Markowitz, MPT isn't just about randomly picking different investments. It's a mathematical approach that helps investors construct portfolios to optimize returns for a given level of risk. The genius of MPT lies in its focus on asset correlation – how different investments move in relation to each other.

The idea is to combine assets that don't move in perfect lockstep. Ideally, you want investments that are uncorrelated, or even negatively correlated, meaning when one goes down, the other might go up or at least stay stable. For example, US Treasuries and small-cap stocks have historically shown a negative correlation, meaning adding a small position in Treasuries to a stock-heavy portfolio can significantly reduce volatility without drastically impacting expected returns. MPT helps you find that "efficient frontier," which represents the set of optimal portfolios offering the highest expected return for a specific level of risk, or the lowest risk for a desired return. It's a sophisticated way to ensure your diversification isn't just broad, but smart.

One common pitfall for US investors is what's known as "home country bias." We tend to heavily favor US stocks, often overlooking the vast opportunities (and diversification benefits) available internationally. While the US market is significant, diversifying geographically by investing in international stocks, including developed and emerging markets, can protect your portfolio from downturns specific to the US economy. It's a global economy, after all, and your portfolio should reflect that reality.

Your Personal Blueprint: Risk Tolerance and Rebalancing

Now, all this talk of asset classes and correlations might sound a bit abstract, but it always comes back to you. Your personal risk tolerance, financial goals, and time horizon are the ultimate guides for your diversification strategy. A younger investor with decades until retirement might comfortably take on more risk, leaning heavier into equities, while someone nearing retirement might prioritize capital preservation and shift towards a more conservative mix with a higher bond allocation. There's no one-size-fits-all answer; it's about finding the right balance that lets you sleep soundly at night while still working towards your financial aspirations.

And here's a crucial point that often gets overlooked: diversification isn't a "set it and forget it" kind of deal. Even the most perfectly constructed portfolio needs periodic rebalancing. Over time, some of your investments will grow more than others, shifting your original asset allocation. If your stocks have had a fantastic run, they might now represent a larger percentage of your portfolio than you initially intended, potentially increasing your risk exposure. Rebalancing means selling off some of the assets that have performed well and reinvesting in those that have lagged, bringing your portfolio back to your target allocation. This disciplined approach ensures your portfolio remains aligned with your risk tolerance and long-term goals, acting as a negotiation between risk and reward.

For those who find managing all these moving parts a bit daunting, there are fantastic tools available. Index funds and Exchange-Traded Funds (ETFs) offer instant, cost-effective diversification across broad market segments, industries, or even international markets. And if you're planning for a specific goal like retirement, target-date funds can simplify the process even further, automatically adjusting their asset allocation to become more conservative as you approach your target date.

Ultimately, diversification is more than just a buzzword; it's a fundamental principle that empowers you to navigate the complexities of the investment world with greater confidence. It’s about building a portfolio that’s robust enough to handle the market’s surprises, allowing you to focus on your life, knowing your financial future is being tended to with care. So, take a moment to look at your own financial basket. Is it diversified enough? Are you spreading your eggs wisely? A little thoughtful planning now can lead to a much smoother, more secure journey down the road.

You might also like

Unlock Your Inner Gymnast: A Beginner's Guide to Starting at Home

Ever dream of flying through the air with grace and power? You don't need a fancy gym to start your gymnastics journey. Here's how to begin right in your living room.

Keeping Our Furry Family Safe: A Holiday Survival Guide for Pet Parents

The holidays are a magical time, full of joy and togetherness, but for our beloved pets, they can also hide some unexpected dangers. Let's make sure our dogs and cats have a safe and happy festive season.

Planting Roots in the Sunshine State: A Real Estate Guide for the Venezuelan Community

Thinking about buying a home in Florida? You're not alone. Let's walk through the journey of turning that dream into a reality, from understanding the market to securing your own piece of sunshine.

Don't Wait for the Storm: A Pet Owner's Guide to Emergency Planning

It's a thought no pet owner wants to have, but preparing for a disaster is one of the most important things we can do. Here’s how to build a solid plan that keeps your furry family members safe.

That Long Layover in Hong Kong? It Might Be the Best Part of Your Trip.

A long layover used to feel like a travel punishment. But at Hong Kong International Airport, it's an unexpected opportunity for adventure, food, and serious relaxation.