Is Peer-to-Peer Lending a Safe Bet for Your Money in 2025?

It promises higher returns than the bank, but is P2P lending actually a safe place to grow your money? Let's have an honest conversation about the risks and rewards.

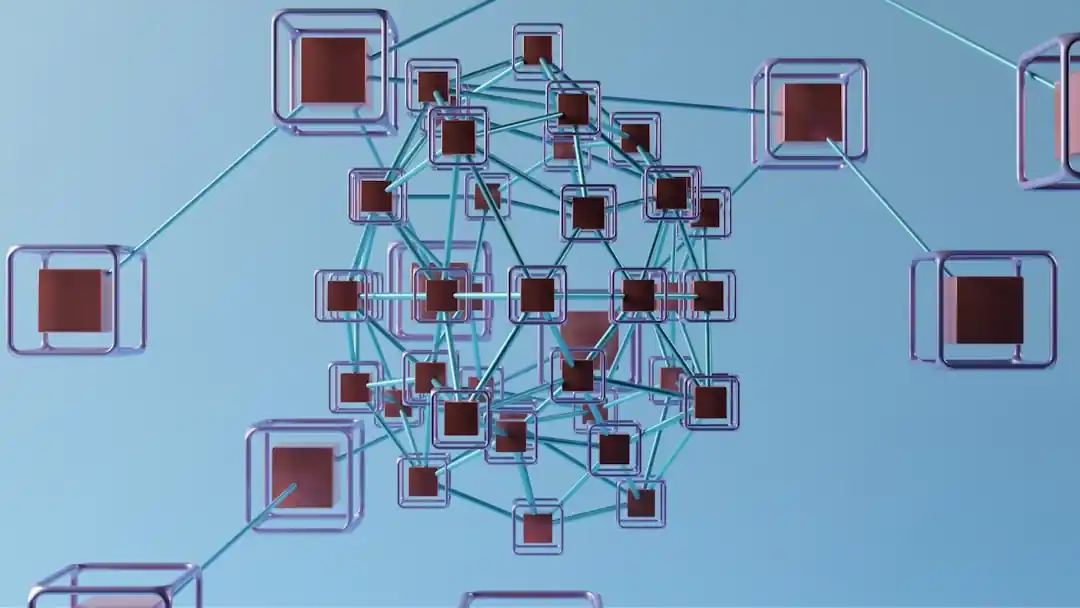

Let's have a real conversation about money. For years, the path to investing seemed pretty straightforward: you’d talk to a financial advisor, buy some stocks, maybe a few bonds, and let your money sit in a savings account that barely kept up with inflation. But the world of finance has been quietly undergoing a revolution, and one of the most interesting developments is peer-to-peer (P2P) lending. The concept is simple and powerful: it’s a digital marketplace that directly connects people who want to invest money with people who need to borrow it, cutting out the traditional bank entirely.

I remember the first time I stumbled upon a P2P lending platform. The advertised returns—often significantly higher than what any bank was offering—seemed almost too good to be true. It felt like a more democratic way to handle money, where you could act as the bank and earn the interest that would normally go to a massive corporation. This isn't some fringe idea anymore. The P2P lending market has exploded into a colossal industry. But with that growth comes the inevitable and crucial question, especially as we look at our finances in 2025: Is it actually safe?

The allure is undeniable. You're tired of seeing your savings generate pennies, and the idea of building a source of passive income is incredibly appealing. P2P lending presents itself as a modern solution. But investing is never just about the potential upside; it's about understanding the full picture. It’s about weighing the exciting possibilities against the very real risks. So, before you even think about transferring a single dollar, let's sit down and honestly unpack what you’re getting into.

The Bright Side: Why People Are Drawn to P2P Lending

The number one reason investors flock to P2P lending is the potential for higher returns. It’s as simple as that. In a world where high-yield savings accounts might offer you 4-5% if you're lucky, many P2P platforms historically boast average annual returns that can range from 7% to 12% or even higher, depending on the risk level of the loans you choose to fund. This isn't just a small step up; it's a significant leap that can dramatically accelerate your wealth-building journey. This is money that works harder for you, generating meaningful passive income month after month as borrowers make their repayments.

Beyond the attractive yields, P2P lending offers a powerful tool for diversification. You’ve probably heard the old adage, "Don't put all your eggs in one basket." P2P lending gives you a completely different kind of basket, one that isn't directly tied to the volatility of the stock market. A downturn on Wall Street doesn't necessarily mean your P2P investments will suffer. Furthermore, within P2P lending itself, you can diversify on a micro-level. Instead of funding one large loan, you can spread your investment across hundreds, or even thousands, of small loan portions. You can invest in personal loans, small business loans, and real estate loans, each with different risk profiles, creating a resilient portfolio that isn't dependent on a single borrower's ability to pay.

There's also a certain satisfaction that comes from this model. You're not just a number in a vast, faceless financial system. You can often see the (anonymized) purpose of the loans you're funding—whether it's helping someone consolidate debt, a small business expand its operations, or a family renovate their home. It adds a human element to investing that is often missing from traditional avenues. You are directly fueling individual goals and ambitions, and in return, you're earning a solid return. It’s a symbiotic relationship that feels more grounded and tangible than buying shares of a multinational corporation.

The Unvarnished Truth: Understanding the Risks

Now, for the part of the conversation that truly matters. With the promise of higher returns comes inherent risk, and in P2P lending, the primary risk is borrower default. This is the unavoidable reality that some borrowers will not be able to pay back their loans. Unlike the money in your bank's savings account, your P2P investments are not FDIC-insured. If a borrower defaults, you can lose your entire investment in that loan. While platforms have sophisticated algorithms to assess creditworthiness, no system is perfect. An unexpected job loss or medical emergency can derail even the most well-intentioned borrower, and during an economic downturn, default rates can rise across the board.

The next layer of risk is platform risk. You are placing a great deal of trust in the P2P company itself. These platforms are the intermediaries that service the loans, process payments, and manage the entire operation. What happens if the platform goes out of business? While there are regulations in place requiring platforms to have a plan for such an event, a sudden collapse could make it incredibly difficult and messy to recover your funds. You have to vet the platform with as much scrutiny as you vet the borrowers. How long have they been in business? Are they profitable? How transparent are they about their own financials and loan performance data?

Finally, there's liquidity risk. P2P loans are not like stocks that you can sell in a matter of seconds. When you invest in a loan, your money is typically tied up for the entire term, which could be anywhere from one to five years. If you suddenly need cash, you can't just pull it out. Some platforms offer secondary markets where you can try to sell your loan parts to other investors, but there's no guarantee you'll find a buyer, and you may have to sell at a discount. This makes P2P lending unsuitable for your emergency fund or for money you might need in the short term. It’s an investment that requires patience.

Strategies for Safer P2P Investing

If you've weighed the pros and cons and are still interested, the good news is that you don't have to go in blind. You can significantly mitigate the risks by being a smart, disciplined investor. The single most important strategy, as mentioned before, is radical diversification. Never, ever invest a large sum into a single loan. Instead, spread your capital as thinly as possible across the maximum number of loans the platform allows. Investing just $25 into 40 different loans is infinitely safer than investing $1,000 into one. This ensures that if one loan defaults, the impact on your overall portfolio is minimal.

Thorough due diligence is your next line of defense. Spend time researching the platforms themselves. Stick to larger, more established players in the US market that have a long track record and are transparent with their data. Read through their SEC filings. Scour forums and reviews to see what other investors are saying. Understand the different risk grades they assign to borrowers and decide on an allocation that matches your personal risk tolerance. Some investors stick exclusively to the highest-grade borrowers for lower returns but greater safety, while others may allocate a small portion of their portfolio to riskier loans in pursuit of higher yields.

Finally, start small and be patient. There's no need to jump into the deep end. Start with a small amount of money that you are comfortable losing. Treat your first year as an educational experience. Watch how your portfolio performs, track the defaults, and get a feel for the platform and the process. As you become more comfortable and knowledgeable, you can gradually increase your investment over time. This measured approach allows you to learn the ropes without exposing yourself to significant financial danger, turning a potentially risky venture into a calculated and manageable part of your overall investment strategy.

A Final Thought

Peer-to-peer lending is neither a guaranteed path to riches nor a reckless gamble. It is a legitimate, alternative investment class with a unique profile of risks and rewards. It offers a compelling solution for those seeking to escape the low-yield world of traditional savings and are willing to take on a bit more risk for a potentially greater reward. The key to safety isn't finding an investment with zero risk—because no such thing exists—but in understanding, respecting, and actively managing the risks you choose to take. By embracing diversification, committing to due diligence, and exercising patience, you can navigate the world of P2P lending wisely, and it just might become a valuable and rewarding component of your financial future.

You might also like

How to Talk Money with Your Lawyer: A Guide to Negotiating a Criminal Defense Payment Plan

Facing criminal charges is stressful enough without the added anxiety of legal fees. Here’s how to have an open, honest conversation with an attorney about a payment plan that works for you.

The Epic Whisper of the Rails: A Guide to the Trans-Siberian Railway

Ever dreamt of a journey that stretches across continents, where every clickety-clack of the train wheels tells a new story? The Trans-Siberian Railway is more than just a trip; it's an odyssey, and I'm here to share how to make it yours.

H1B Taxes in the US: The Guide You Wish You Had Sooner

Feeling a little lost navigating the U.S. tax system on an H1B visa? You're not alone. Let's break down the essentials, from residency status to FICA, in a way that actually makes sense.

A New Beginning: Your Financial Planning Guide for Life in the USA

Starting over in a new country is a monumental journey. For Venezuelan immigrants in the US, building a strong financial foundation is key to turning dreams into reality. Here’s how to start.

Unlocking the Magic: How Aperture Transforms Your Photos with Depth of Field

Ever wonder how some photos have that dreamy, blurred background while others are tack-sharp from front to back? It's all about aperture and its incredible dance with depth of field, and honestly, once you get it, your photography will never be the same.