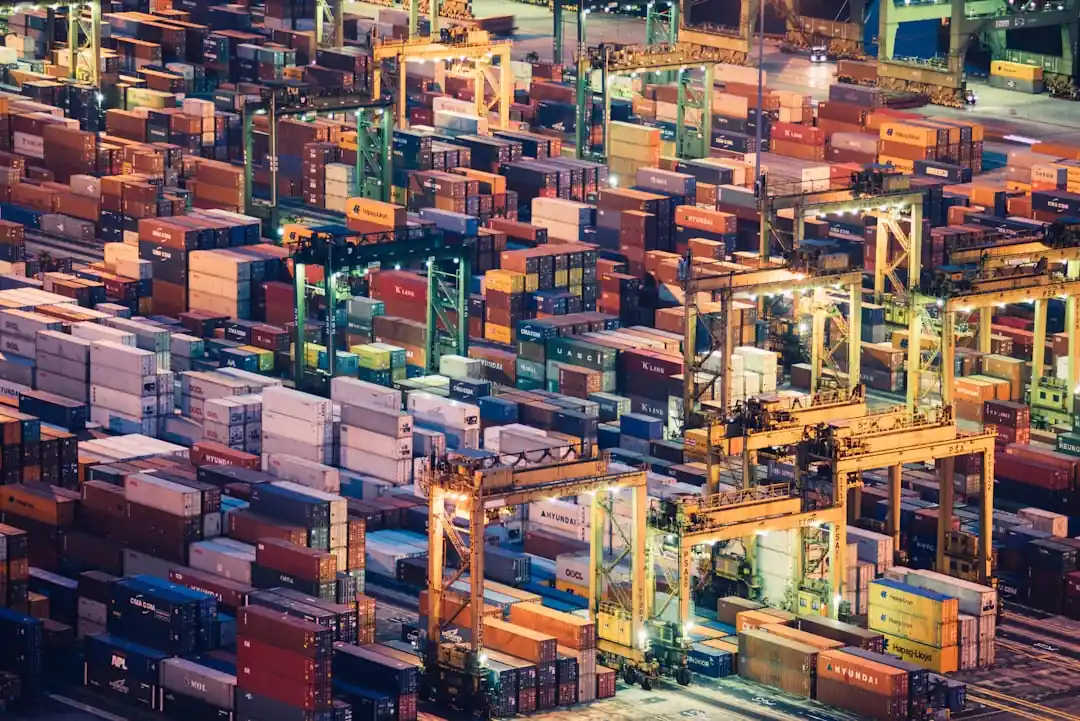

The Inflation Squeeze: How Rising Costs Are Reshaping Supply Chains

We all feel inflation at the checkout, but its real battleground is the global supply chain. Let's unpack how it's forcing businesses to rethink everything from shipping to strategy.

If you’ve found yourself doing a double-take at a receipt recently, you're not alone. We’ve all felt the sting of inflation in our daily lives, from the gas pump to the grocery aisle. It’s a conversation happening at dinner tables across the country. But behind these noticeable price hikes, there's a much larger, more complex drama unfolding—one that’s playing out in ports, warehouses, and factory floors around the world. I’m talking about the immense pressure inflation is putting on supply chain management.

Honestly, it’s a topic that can feel a bit abstract, full of business jargon. But the reality is, the journey of a product from a sketch on a notepad to the item in your shopping cart has become a high-stakes obstacle course. For decades, the name of the game was "lean and mean." Companies built incredibly efficient, just-in-time systems designed to minimize costs. It was a marvel of global coordination. Then, a series of global shocks threw a wrench in the works, and suddenly, that finely tuned machine started to sputter.

This new economic environment, defined by rising costs and uncertainty, is forcing a radical rethink of how business is done. It’s not just about things getting more expensive; it’s about the fundamental strategies of how goods are made, moved, and stored being rewritten in real-time. And understanding this shift is key to understanding the modern economy.

The Obvious Enemy: A Tidal Wave of Costs

The most direct hit from inflation comes in the form of, well, costs. And it’s not just one thing. It’s a relentless, multi-front battle against rising expenses that touches every single link in the supply chain. Think of it less as a single price increase and more as a tidal wave that lifts everything with it.

First, you have the raw materials. Whether it’s the steel for a car, the cotton for a t-shirt, or the microchips for a phone, the cost of basic inputs has soared. This isn't just a minor bump; we've seen dramatic increases in the Producer Price Index, which is a measure of what manufacturers are paying. When the cost of core components goes up, that expense doesn't just get absorbed. It creates a ripple effect, getting passed from the supplier to the manufacturer, to the distributor, and, ultimately, to us.

Then there’s the journey itself. Transportation costs have been on a wild ride. We all remember the headlines about skyrocketing container shipping rates. While those have cooled from their panic-inducing peaks, the overall cost of moving goods—whether by ship, truck, or train—remains significantly higher than it was just a few years ago. Fuel prices are a huge factor here, and their volatility makes it incredibly difficult for logistics companies to budget and offer stable pricing.

And we can't forget the people. Labor costs have also risen sharply. Warehouses, trucking companies, and ports have had to increase wages to attract and retain workers in a tight labor market. This isn't a bad thing for workers, of course, but it adds another layer of expense that contributes to the final price tag of a product. It’s a perfect storm where every element feeds the others, creating a cycle of escalating costs.

From 'Just-in-Time' to 'Just-in-Case'

For years, the gold standard in supply chain management was the "just-in-time" (JIT) model. The philosophy was simple: minimize waste and storage costs by having materials and products arrive exactly when they were needed. It was beautiful in its efficiency. But when the pandemic hit and disruptions became the norm, the fragility of JIT was laid bare. An entire assembly line could be shut down for want of a single, delayed part.

In response, the pendulum has swung dramatically in the other direction, toward a "just-in-case" (JIC) strategy. Businesses are now intentionally holding more inventory—more raw materials, more components, more finished goods—to act as a buffer against potential disruptions. It’s a form of self-insurance. The problem? It’s expensive.

Holding more inventory means you need more warehouse space, which costs money. It means more of your company's cash is tied up in products that are just sitting there, not generating revenue. It also increases the risk of that inventory becoming obsolete, especially in fast-moving industries like fashion or electronics. If a new trend or technology emerges, you could be left with a warehouse full of products nobody wants.

This strategic shift is a direct consequence of uncertainty. When you can't be sure that your shipment will arrive on time, or if its price will suddenly double, you start to build walls to protect yourself. This is why companies are now investing heavily in visibility tools—sophisticated software that provides real-time data on where their shipments are, what’s happening in their factories, and how much stock they have on hand. In an inflationary world, data isn't just helpful; it's a lifeline.

The New Playbook: Building Resilient Supply Chains

So, what’s the answer? Businesses can't just sit back and absorb endless cost increases. They’re actively rewriting their playbooks to build supply chains that are not just efficient, but also resilient. The new goal is to create a system that can bend without breaking.

A major part of this is supplier diversification. The old model of relying on a single, low-cost supplier in one part of the world is now seen as incredibly risky. Companies are spreading their bets, working with multiple suppliers in different geographic regions. If a factory in one country shuts down or a port gets congested, they can pivot to another source. This move away from single-sourcing is one of the most significant strategic shifts happening in business today.

Technology is also playing a starring role. Companies are pouring money into AI and machine learning to improve their demand forecasting. They’re using advanced analytics to spot potential bottlenecks in their supply chain before they become major problems. In warehouses, automation and robotics are helping to offset rising labor costs and improve efficiency. It’s a technological arms race, and the companies that invest wisely will be the ones who come out ahead.

Finally, we’re seeing a renewed interest in nearshoring and reshoring—that is, moving production closer to the end consumer. For US companies, this might mean moving a factory from Asia to Mexico or even back to the United States. While it might not always be the cheapest option in terms of labor, it can drastically reduce shipping times and costs, and it gives companies far more control over their production. It’s a trade-off between immediate cost and long-term stability.

The era of inflation has been a stressful and challenging one, but it has also been a powerful catalyst for innovation. It has forced a generation of business leaders to confront the vulnerabilities in their systems and to start building something stronger and more adaptable. The journey is far from over, but it’s a necessary one. And as we navigate this new economic landscape, the resilience of our supply chains will be more important than ever.

You might also like

Journey into the Green Heart: The Best Amazon Rainforest Documentaries

Ever dreamt of exploring the Amazon? These documentaries offer a breathtaking, intimate look into the world's most vital ecosystem, right from your couch.

The Ultimate South Island Road Trip: A Guide for the Modern Explorer

Dreaming of dramatic landscapes and unforgettable adventures? A road trip through New Zealand's South Island is an absolute must. Here's how to plan the adventure of a lifetime.

From Pocket Change to Precious Metal: Weaving Gold into Your Personal Savings Plan

Feeling like your savings need a little more... shine? Let's talk about the age-old secret to financial stability and how you can make gold a part of your modern savings strategy.

Beyond the Billboard: 7 Modern Ways for Car Accident Law Firms to Win More Clients

Is your car accident law firm struggling to connect with new clients? It's time to move beyond old-school tactics. Here’s how to build a powerful client-attraction engine in the digital age.

Tame the Tone Beast: A Guitarist's Guide to Managing Quad Cortex Presets

Feeling overwhelmed by your Quad Cortex library? You're not alone. Discover how Cortex Control transforms preset chaos into creative clarity, making tone management a breeze.