That Sinking Feeling: How to Stop Federal Student Loan Wage Garnishment

Getting a notice that your wages will be garnished is terrifying. But you're not powerless. Let's talk about how to stop it and get back on solid ground.

Let’s be brutally honest. There are few things that can make your stomach drop faster than opening a letter and learning that your wages are about to be garnished. It’s a deeply personal and invasive feeling—the idea that your hard-earned money will be taken before you even have a chance to manage it. For so many of us, that paycheck is the lifeline that covers rent, groceries, and the basic costs of living. The thought of it shrinking by 15% is not just stressful; it’s terrifying.

If you’re reading this, you’re likely either staring down the barrel of a wage garnishment notice or living in fear of one arriving. First, take a breath. The situation is serious, but it is not hopeless. You have rights and, more importantly, you have options. This isn't a dead end. It's a crossroads that requires you to take a specific path, but there is a way out.

I remember the first time a friend of mine went through this. He was a high school teacher, and he just ignored his student loans for years, thinking he could deal with them "later." Later came in the form of a notice from his school district's HR department. The shame and panic he felt were palpable. He thought his financial life was over. But it wasn't. He got through it, and you can, too.

What Exactly Is Administrative Wage Garnishment?

Before we talk about the solutions, let's quickly demystify the problem. When your federal student loans are in default (which usually happens after 270 days of non-payment), the U.S. Department of Education has a powerful tool it can use to collect the debt: Administrative Wage Garnishment, or AWG. Unlike other creditors who usually need to sue you and get a court judgment, the government can order your employer to garnish your wages directly.

This process allows them to take up to 15% of your disposable pay. What’s disposable pay? It’s the amount left over after your employer makes legally required deductions like taxes. It’s a significant amount of money, and for most people, losing it creates immediate and severe financial hardship. It’s an aggressive collection method, and it’s meant to get your attention. The good news is that it also opens the door to specific programs designed to resolve the default and stop the garnishment.

You essentially have two main highways out of this situation: Loan Rehabilitation and Loan Consolidation. Each has its own map, its own timeline, and its own benefits. Let's break them down.

Path #1: Student Loan Rehabilitation (The Credit-Saver)

Loan rehabilitation is often called the best method for getting out of default, and for good reason. Its main superpower is that it not only stops the garnishment but also removes the record of the default from your credit report. In the long run, this is a massive benefit for your financial health.

So, how does it work? You must contact the collection agency that has your loan and agree to a "reasonable and affordable" payment plan. This isn't some arbitrary number they pluck from the sky. It's typically calculated as 15% of your annual discretionary income, divided by 12. For many people, this can result in a surprisingly low monthly payment, sometimes as low as $5. You then have to make nine of these payments, on time, over a ten-month period.

The catch? The garnishment doesn't stop immediately. Your employer will continue to take money from your paycheck until you've made at least five of those nine required payments. It’s a test of your commitment. But once you cross that five-payment mark, the garnishment order is lifted. After you complete all nine payments, your loan is officially considered rehabilitated. It’s brought back into good standing, the default is wiped from your credit history, and you regain eligibility for things like deferment, forbearance, and future federal student aid. It's a powerful reset button, but you generally only get one shot at it, so you have to see it through.

Path #2: Direct Consolidation Loan (The Fast-Track)

If the thought of waiting five more months for the garnishment to stop is simply not an option, then a Direct Consolidation Loan might be your best bet. This is often the faster way to halt a wage garnishment.

Consolidation involves taking your existing defaulted federal loan (or loans) and rolling them into a brand new federal loan. This new loan pays off the old ones, and just like that, you are technically no longer in default on those original loans. To do this while in default, you typically have two options: you can either agree to repay the new consolidation loan on an Income-Driven Repayment (IDR) plan, or you can make three consecutive, on-time, voluntary full monthly payments on the defaulted loan before you consolidate. For most people facing garnishment, agreeing to the IDR plan is the most direct route.

The biggest pro here is speed. Once your consolidation application is processed and the new loan is disbursed, the garnishment stops. This can bring relief to your paycheck in a matter of weeks rather than months. However, there's a significant trade-off: consolidation does not remove the record of the default from your credit report. It will show the loan as "paid in full" or "paid by consolidation," but the history of the default itself remains for seven years. Furthermore, any outstanding interest on your old loan gets capitalized, meaning it's added to your new principal balance, so you'll be paying interest on a slightly larger amount.

Making the Choice: Which Road to Take?

So, how do you choose? It really comes down to what you need most right now.

-

Choose Rehabilitation if: Your primary goal is to repair your credit. If you can withstand the garnishment for a few more months, the long-term benefit of having the default removed from your credit history is enormous. It can make a huge difference when you want to apply for a car loan, a mortgage, or even a new apartment.

-

Choose Consolidation if: Your most urgent need is to stop the financial bleeding. If the 15% garnishment is pushing you to the brink and you need to maximize your take-home pay as quickly as possible, consolidation is the faster path to relief.

Honestly, neither path is "easy." Both require paperwork and persistence. But they are clear, established routes to resolving a terrifying situation. The worst thing you can do is what my friend did initially: nothing. Ignoring the problem will not make it go away.

Taking that first step—whether it's calling the collection agency to ask about rehabilitation or starting a consolidation application on StudentAid.gov—is the most powerful thing you can do. It's the moment you stop being a victim of your circumstances and start taking back control of your financial future. It’s a difficult journey, but it’s one you don’t have to walk alone, and the peace of mind on the other side is worth every step.

You might also like

So, You Want to Collect Art? Here’s How to Start Without a Trust Fund

Forget the stuffy galleries and intimidating price tags. Starting a contemporary art collection is more about passion and a little know-how than it is about a massive budget. Let's break it down.

The Best Ways to Get From Vancouver Airport to Whistler

Just landed at YVR and dreaming of the mountains? Figuring out the last leg of your journey to Whistler can be a puzzle. Let's break down the best ways to get from the airport to the slopes.

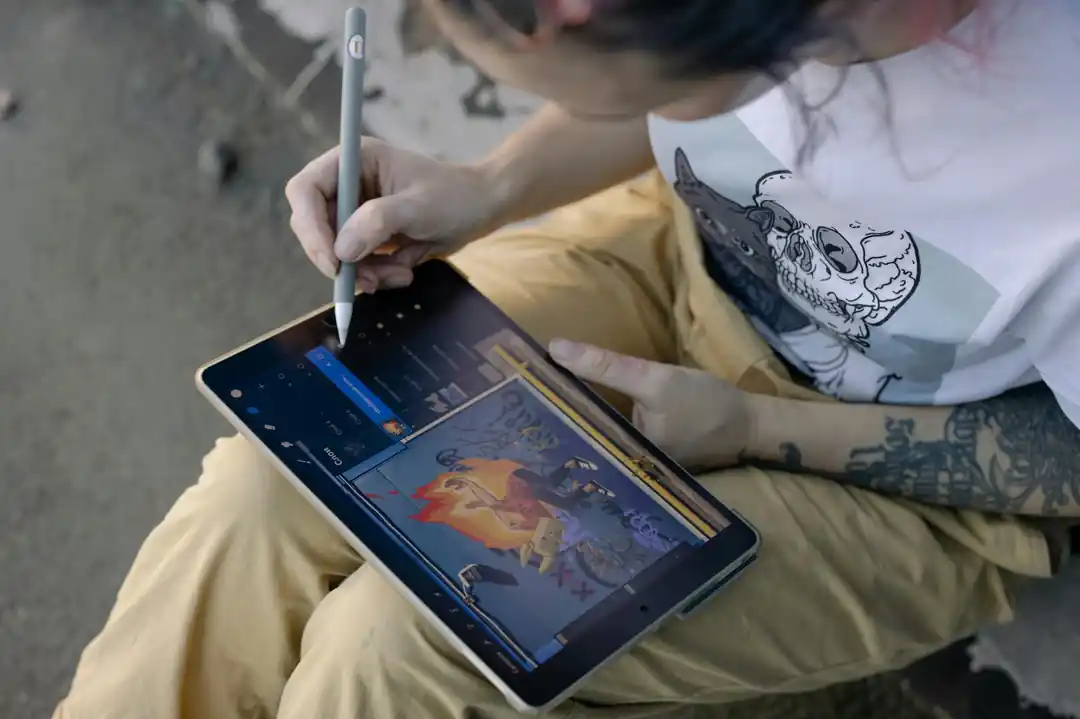

Your First Digital Canvas: The Best Drawing Tablets for Beginners in 2026

Ready to dive into digital art but stuck on which tablet to buy? I get it. Let's break down the best beginner-friendly drawing tablets to get you creating without the confusion.

Unlocking the Cosmos for Less: Your Guide to Saving on Kennedy Space Center Tickets

Dreaming of a trip to Kennedy Space Center but worried about the cost? I've been there! Let's explore some smart ways to make your visit to this incredible hub of space exploration more budget-friendly.

Tame the Tone Beast: A Guitarist's Guide to Managing Quad Cortex Presets

Feeling overwhelmed by your Quad Cortex library? You're not alone. Discover how Cortex Control transforms preset chaos into creative clarity, making tone management a breeze.