Beyond the Hype: A Real-Talk Guide to Analyzing a Company's Financial Health

Tired of feeling like you're guessing with your investments? Let's pull back the curtain and learn how to read a company's financial story. It's easier than you think.

Let’s be honest for a second. How many times have you heard about a “hot” stock from a friend, a news headline, or a random social media post and felt that pull to jump in? It’s a common feeling, that mix of excitement and fear of missing out. But building real, sustainable wealth through investing isn’t about chasing trends; it’s about making informed, confident decisions. And that confidence comes from one place: understanding the true financial health of a company before you put your hard-earned money on the line.

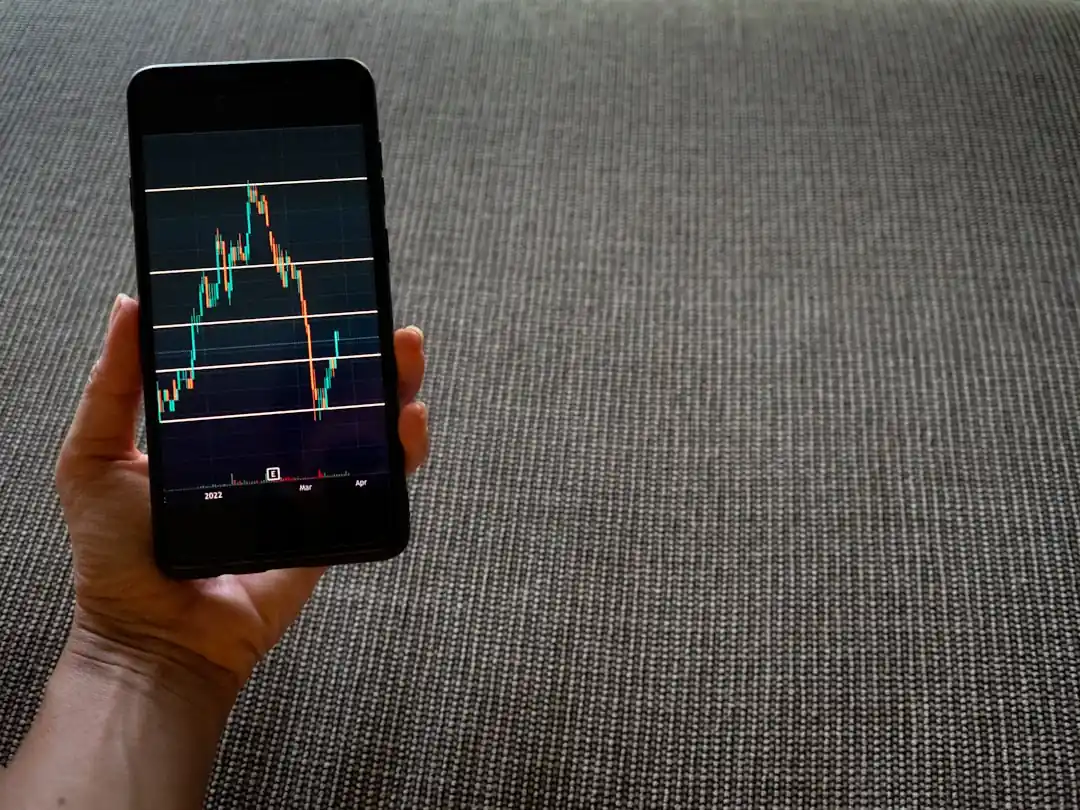

I used to think that analyzing a company's financials was something reserved for Wall Street wizards in slick suits. The language seemed impenetrable, full of acronyms and jargon designed to keep regular people out. But I eventually realized that was just a story I was telling myself. At its core, financial analysis is simply about being a detective. It's about asking the right questions and knowing where to find the clues to piece together the real story of a business, far from the marketing gloss and the daily stock price rollercoaster.

This isn't about finding a magic formula that guarantees a win. Instead, it's about building a repeatable process, a framework for thinking that helps you separate the solid, well-run businesses from the ones that are built on a shaky foundation. It’s about shifting from a speculator to a true investor. So, let's demystify this process together. We'll walk through the essential documents, the key numbers to look for, and the subtle red flags that can save you from a bad decision.

The Foundation: Getting to Know the Three Key Financial Statements

Before you can analyze anything, you need to know where to look. Every publicly traded company is required to publish three core financial statements. Think of them as the three legs of a stool—you need all of them to get a stable, complete picture. They are the Income Statement, the Balance Sheet, and the Cash Flow Statement. Let's break them down in simple terms.

First up is the Income Statement. This is probably the one you've heard of most often, sometimes called the Profit & Loss (P&L) statement. It tells you how profitable a company has been over a specific period (like a quarter or a year). It starts with the company's total revenue (the money it brought in), subtracts the costs and expenses involved in running the business, and ends with the "bottom line": the net income or profit. Reading this helps you answer questions like: Is the company's revenue growing? Are its profits growing? Is it managing its expenses effectively?

Next, we have the Balance Sheet. Unlike the income statement, which covers a period of time, the balance sheet is a snapshot at a single point in time. It follows a fundamental accounting equation: Assets = Liabilities + Equity. Assets are everything the company owns that has value (cash, inventory, property). Liabilities are everything it owes (debt, accounts payable). Equity is what's left over for the shareholders. This statement is crucial for understanding how the company is structured. Does it have a mountain of debt? Does it have enough assets to cover its short-term obligations?

Finally, and arguably most importantly, is the Cash Flow Statement. This document is the ultimate reality check. While the income statement can be influenced by various accounting rules, the cash flow statement tracks the actual cash moving in and out of the company. It’s broken into three parts: cash from operations (the core business), cash from investing (buying or selling assets), and cash from financing (issuing debt, paying dividends). A company can look profitable on its income statement but be burning through cash. A healthy company consistently generates more cash than it uses.

Key Ratios: Turning Numbers into Insights

Once you're comfortable with the three main statements, you can start calculating some simple ratios to gain deeper insights. Ratios are powerful because they put numbers into context and allow you to compare a company against its own history or its competitors. You don't need to be a math genius; a simple calculator (or a quick Google search) is all you need.

One of the most famous is the Price-to-Earnings (P/E) Ratio. It's calculated by dividing the stock price by the company's earnings per share. It gives you a sense of how much investors are willing to pay for each dollar of earnings. A high P/E can mean a stock is expensive, or it can mean investors expect high growth in the future. It's most useful when comparing companies in the same industry.

To gauge a company's debt load, the Debt-to-Equity Ratio is your go-to. It compares the company's total liabilities to its shareholder equity. A high ratio (say, over 2.0) can be a red flag, suggesting the company is relying heavily on borrowing to finance its operations, which adds risk. However, what's considered "high" can vary dramatically by industry, so context is key.

For profitability, look at Return on Equity (ROE). This measures how efficiently a company is using its shareholders' money to generate profit. It's calculated by dividing net income by shareholder equity. A consistently high ROE (often above 15-20%) is a sign of a strong, well-managed business with a potential competitive advantage.

Finally, don't forget about liquidity. The Current Ratio (current assets divided by current liabilities) tells you if a company has enough short-term assets to cover its short-term debts. A ratio below 1.0 means it doesn't, which could signal trouble ahead. These are just a starting point, but mastering these few ratios will put you light-years ahead of the average investor.

Beyond the Spreadsheet: Qualitative Factors Matter

Numbers tell a huge part of the story, but not all of it. Some of the most important factors in a company's long-term success can't be found in a financial statement. This is the qualitative side of analysis, and it's just as critical. It involves stepping back and looking at the business as a whole.

First, consider the business model and competitive advantage. How does the company actually make money? Is it a simple, understandable business? More importantly, what protects it from competition? This is what Warren Buffett calls a "moat." It could be a powerful brand (like Apple), a network effect (like Facebook), high switching costs for customers, or a low-cost advantage. A company with a wide, durable moat is much more likely to fend off competitors and generate strong returns for decades.

The quality of the management team is another huge factor. Are the executives experienced and rational? Do they have a track record of making smart decisions with the company's money? Read their annual letters to shareholders. Do they speak candidly about challenges, or do they only talk about their successes? Look for leaders who think like owners and are focused on long-term value creation, not just hitting quarterly targets.

Finally, look at the industry itself. Is the company in a growing industry, or is it facing headwinds from technological change or shifting consumer tastes? A great company in a terrible industry can still struggle, while even an average company can do well when it has a strong tailwind at its back. Understanding the broader landscape is essential for putting a company's potential in the proper context.

Investing is a journey of continuous learning. By combining a solid understanding of the financials with a thoughtful look at the qualitative aspects of a business, you move from being a passive participant to an active, engaged owner. You start making decisions based on value, not on noise. And that is the most powerful financial tool of all.

You might also like

The Digital Gold Rush: How Online Lotteries Really Make Their Money

Ever wondered what happens behind the scenes when you buy that online lottery ticket? It's more than just ticket sales; there's a whole ecosystem designed to keep the digital wheels turning and the profits flowing.

Scouting the Future: Your Guide to Becoming a Professional Football Scout

Dream of discovering the next football superstar? This guide breaks down the essential steps, skills, and certifications needed to turn your passion for the game into a professional scouting career.

The Second Crash: Tips for Negotiating Medical Bills After a Car Accident

A car accident is traumatic enough. Then the bills arrive. Here’s how to navigate the confusing, often overwhelming, world of medical billing and negotiate for a fair outcome.

The Great Rewiring: What to Expect Psychologically During the Teen Years

Adolescence is more than just growth spurts and mood swings. It's a profound psychological journey for both boys and girls. Let's dive into the key changes happening inside the teenage brain.

The Ultimate Beginner's Guide to Micro-Investing

Ever felt like investing was a club you weren't invited to? Micro-investing is changing that, one penny at a time. Here's how to start building wealth with the spare change in your pocket.