The Ultimate Guide to Choosing the Right Personal Insurance

Feeling overwhelmed by insurance options? You're not alone. Let's break down the essential types of personal insurance to help you build a financial safety net that brings true peace of mind.

Let's be honest: "insurance" isn't exactly a word that sparks excitement. For many, it brings to mind confusing paperwork, monthly bills, and a vague sense of dread about worst-case scenarios. I get it. For years, I treated insurance as a necessary evil, something to set up and forget, hoping I'd never actually need it. But a small kitchen fire a few years ago (don't worry, everyone was fine!) completely changed my perspective. That moment, seeing the smoke and realizing how much worse it could have been, transformed my view of insurance from a burden into what it truly is: a powerful tool for peace of mind.

It’s your personal financial safety net, meticulously woven to catch you when life, in its unpredictable way, tries to knock you off your feet. In the US, where safety nets can sometimes feel few and far between, building your own is not just a smart financial move; it's an essential act of self-reliance and care for yourself and your loved ones. The goal isn't to live in fear of what might happen, but to live more freely, knowing you've put protections in place. So, let's demystify this topic together, breaking down the core types of personal insurance and how to choose the right coverage for your unique journey.

Health Insurance: The Cornerstone of Your Well-being

In the United States, there is no conversation about financial security that doesn't start with health insurance. The cost of medical care can be staggering, and a single unexpected illness or accident can have devastating financial consequences. I once read a report from the American Journal of Public Health that noted medical issues contribute to a huge number of personal bankruptcies. That’s a sobering thought, and it underscores why having solid health coverage is non-negotiable.

So, what are you looking for? Health insurance plans come in many forms, such as HMOs, PPOs, and EPOs, which primarily differ in their network of doctors and hospitals and whether you need a referral to see a specialist. If you get insurance through your employer, you'll likely have a few plans to choose from during open enrollment. If you're self-employed or your job doesn't offer it, the Health Insurance Marketplace is your go-to resource. When comparing plans, don't just look at the monthly premium. Pay close attention to the deductible (what you pay before insurance kicks in), co-pays, and the out-of-pocket maximum. A lower premium might seem appealing, but it could come with a deductible so high that it's almost like having no insurance at all for minor to moderate issues.

Life Insurance: A Promise to Your Loved Ones

Talking about life insurance can feel uncomfortable, but I encourage you to reframe it. Think of it not as planning for your death, but as a profound act of love for the people who depend on you. It’s a financial tool that ensures your family can remain financially stable, cover debts, and pursue their dreams even if you're no longer there to provide for them. It’s about leaving a legacy of security, not a legacy of bills.

The two main categories you'll encounter are Term Life and Permanent (or Whole) Life. Term life is straightforward and affordable; you buy coverage for a specific period (like 20 or 30 years), and if you pass away during that term, your beneficiaries receive a payout. It’s often a great choice for people whose biggest need is to cover a mortgage or provide for young children. Permanent life insurance, on the other hand, covers your entire life and includes a cash value component that grows over time. It's more complex and expensive, but it can be a tool for estate planning or supplemental retirement income. For most people, especially those just starting, term life provides the most protection for the lowest cost.

Auto Insurance: Your Shield on the Road

For most Americans, a car is a key to freedom and opportunity. It's also a significant responsibility. Auto insurance is legally required in nearly every state, and for good reason. A car accident can happen in a split second, but the financial and legal fallout can last for years. Having the right auto insurance protects you, your passengers, and your fellow drivers. It’s the barrier standing between a bad day and a life-altering financial crisis.

Every policy is built on liability coverage, which pays for injuries and property damage you cause to others. But that's just the starting point. You'll also want to consider collision coverage, which pays to repair your own car after an accident, and comprehensive coverage, which handles non-accident-related damage from things like theft, storms, or falling objects. I also highly recommend adding uninsured/underinsured motorist coverage. It’s a sad reality that many people drive without enough insurance, and this protects you if one of them hits you. Don't just opt for the state minimums; they are often woefully inadequate to cover the costs of a serious accident.

Disability Insurance: Protecting Your Greatest Asset

What is your most valuable financial asset? It's not your house or your car. It's your ability to earn an income. We insure everything else, yet so many of us forget to protect our paycheck. Disability insurance is designed to do just that. If you become sick or injured and can't work, this coverage provides you with a percentage of your income, allowing you to continue paying your bills and maintaining your lifestyle while you recover.

Many people assume they're covered by workers' compensation, but that only applies if your injury or illness is work-related. The Social Security Administration reports that a 20-year-old has a 1-in-4 chance of becoming disabled before reaching retirement age. That's a staggering statistic. Many employers offer group disability plans, which are a great start, but they may not be enough. An individual policy can fill the gaps. When shopping for a plan, look for an "own-occupation" definition of disability, which means the policy will pay out if you can't perform your specific job, not just any job.

Homeowners & Renters Insurance: Guarding Your Space

Your home is more than just a building; it's your sanctuary, filled with your possessions and memories. Homeowners insurance protects that sanctuary from a wide range of perils, including fire, theft, and storms. It also provides crucial liability coverage. If a guest slips on your walkway or your dog bites the mail carrier, your homeowners policy can cover their medical bills and protect you from a lawsuit that could jeopardize everything you've worked for.

And if you rent, please do not make the common mistake of thinking your landlord's insurance covers you. It doesn't. Their policy covers the building, not your personal belongings. Renters insurance is incredibly affordable—often just the cost of a few coffees a month—and it protects your furniture, electronics, clothes, and other valuables from theft or damage. Just like homeowners insurance, it also includes liability protection. Creating a home inventory (a simple list or video of your belongings) is a fantastic first step that will make any future claim process infinitely smoother.

Choosing the right insurance is a deeply personal process. It requires a clear-eyed look at your life, your finances, and your responsibilities. It’s not the most thrilling task, but taking the time to build a comprehensive insurance portfolio is one of the most empowering financial decisions you can make. It allows you to stop worrying about the "what ifs" and focus on living your life to the fullest, with the quiet confidence that you've built a safety net strong enough to handle whatever comes your way.

You might also like

Switzerland's Wild Heart: A Nature Lover's Guide to the Alps

It’s time to trade cityscapes for stunning peaks. If your soul craves crisp mountain air and landscapes that look like they’ve been painted, you’ve come to the right place.

Talent Acquisition vs. Recruiting: It's More Than Just Semantics

Ever wondered if 'talent acquisition' and 'recruiting' are just fancy words for the same thing? Turns out, there's a profound difference that shapes how companies build their future.

Gaza's Ancient History: A Crossroads of Empires

Before the headlines, Gaza was a thriving crossroads of ancient civilizations. Let's journey back in time to uncover the rich, layered history of a land that has connected empires for millennia.

That App Idea in Your Head? You Can Build It (Without Writing a Single Line of Code)

Ever had a brilliant app idea but no clue how to code? The world of no-code AI tools is exploding, and it's turning dreamers into builders. Let's talk about it.

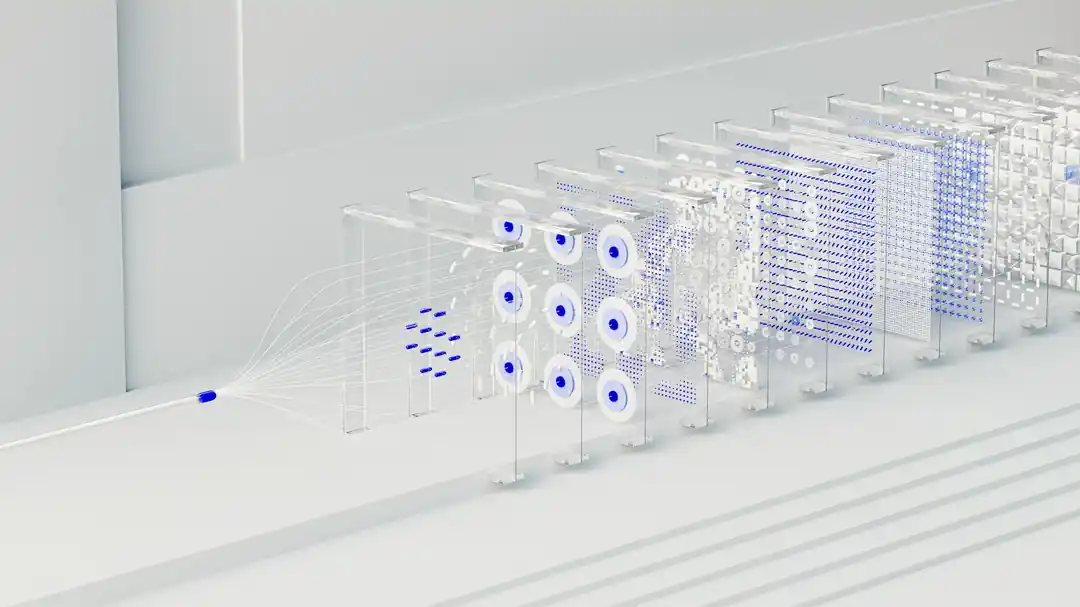

From Sensor to Insight: How AWS Makes the Internet of Things Possible

Ever wonder how all those smart gadgets actually work together? It’s not magic. A lot of the time, it’s the powerful, behind-the-scenes work of platforms like Amazon Web Services (AWS) that turns a simple device into a smart one.