That Pile of Unfiled Taxes? Let's Finally Tackle It Together

The thought of filing back taxes can be paralyzing, but ignoring it isn't an option. Here’s a compassionate, step-by-step guide to getting right with the IRS.

There’s a certain kind of stress that lives in the back of your mind, a low-grade hum of anxiety that you get really good at ignoring. For a lot of people, that stress is shaped like a stack of unfiled tax returns. It’s a task that feels so monumental, so tangled up in fear and confusion, that doing nothing feels easier than starting. I get it. Life happens. Maybe a few years ago, you were freelancing and the paperwork was overwhelming, or you went through a major life event and taxes were the last thing on your mind.

And so, one year of unfiled taxes becomes two, and two becomes… more. The pile grows, and so does the dread. You start to imagine the worst-case scenarios: threatening letters from the IRS, penalties piling up into an insurmountable mountain of debt, or maybe even legal trouble. It’s enough to make anyone want to bury their head in the sand. But what if I told you that the path forward is not nearly as terrifying as you’ve built it up to be?

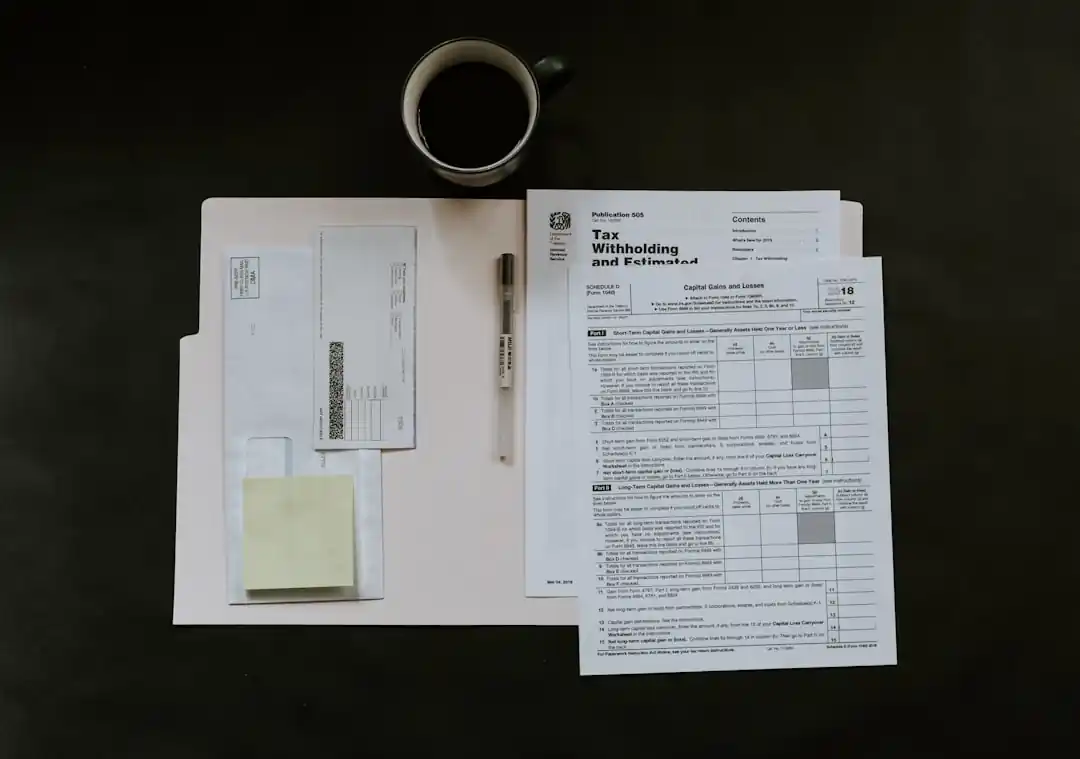

Honestly, the IRS is more interested in getting you back into the system than in punishing you. They have clear, established procedures for people in your exact situation. Taking that first step is the hardest part, but it’s also the most powerful. It’s the moment you decide to stop letting this shadow hang over you and start moving toward financial peace of mind. Let’s walk through it together, not as a lecture, but as a conversation over coffee.

The Sooner, The Better: Why You Shouldn't Wait

Before we get into the "how," let's quickly touch on the "why." Procrastination is tempting, but when it comes to taxes, it’s actively working against you. The two biggest reasons are penalties and potential refunds. The IRS has penalties for both failing to file and failing to pay. The failure-to-file penalty is usually the more severe of the two, calculated as 5% of the unpaid tax for each month the return is late, capping at 25%. The failure-to-pay penalty is smaller, but it all adds up. The longer you wait, the more these penalties and the associated interest grow.

But here’s the flip side that many people forget: you might be owed money! If you were due a refund for a previous year, you have a limited time to claim it. The IRS generally gives you a three-year window from the original tax deadline to file and get your refund. Think about it—you could be leaving hundreds or even thousands of dollars on the table simply because the paperwork seems too daunting. That money is yours, and it could be a huge help.

Beyond the direct financial implications, filing your back taxes is crucial for other parts of your life. If you’re self-employed, filing is how you report your income to the Social Security Administration, which affects your future retirement or disability benefits. Need to apply for a mortgage or a small business loan? Lenders will almost certainly require copies of your filed tax returns. Getting compliant isn't just about settling a debt; it's about unlocking your financial future.

Your Step-by-Step Guide to Getting Caught Up

Alright, deep breath. You can do this. We’re going to break this down into small, manageable steps. You don’t have to do it all in one day. Just focus on one step at a time.

1. Gather Your Ghosts (of Documents Past)

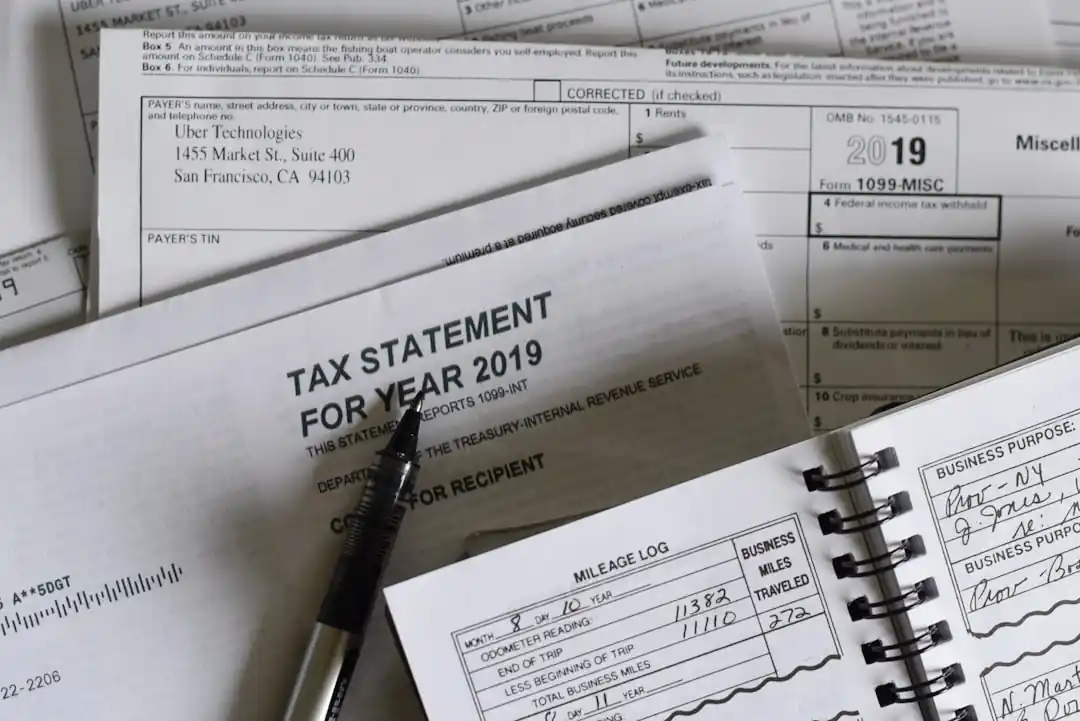

First things first, you need the right paperwork. For each year you need to file, you'll have to collect your income documents. This includes things like W-2s from employers and 1099 forms for any freelance or contract work. Don't panic if you don't have them. The IRS has a fantastic tool for this. You can request a free "Wage and Income Transcript" for past years by filing Form 4506-T. This transcript will show all the income information the IRS has on file for you from employers and other payers. It’s the perfect starting point.

2. Find the Right Forms

Tax forms change from year to year, so you can't just use the current year's 1040 for a return from three years ago. You need the specific forms for the exact year you're filing. Thankfully, the IRS keeps an extensive archive on its website. You can go to the "Forms, Instructions & Publications" section and find prior year forms. Just download the Form 1040 and any other schedules you might need for that specific year.

3. Fill Them Out (and Know When to Ask for Help)

Now it’s time to fill out the returns. Be methodical. Do one year at a time. If your tax situation is simple—say, just a W-2 from a single job—you might be able to handle this yourself using the instructions that come with the forms. However, if things are more complex—multiple income sources, investments, self-employment deductions—this is where I’d strongly suggest calling in a professional. A good tax preparer or CPA who specializes in back taxes can be worth their weight in gold. They know the process inside and out and can ensure everything is filed correctly, potentially saving you money and stress.

4. Mail Them In

For prior-year returns, you generally can't e-file. You’ll need to print out the completed forms and mail them to the IRS. The mailing address will depend on where you live and whether you’re including a payment. The instructions for each year's Form 1040 will have the correct address. It’s a good idea to send them via certified mail so you have proof that the IRS received them. Then, you wait. It typically takes the IRS about six weeks to process a mailed-in past-due return.

What Happens If You Owe? (Don't Panic)

This is the fear that stops most people in their tracks. What if, after all that work, you find out you owe a significant amount of money? First, remember that filing is always the right move, even if you can't pay immediately. The failure-to-file penalty is worse than the failure-to-pay penalty, so by filing, you've already minimized some of the damage.

The IRS is surprisingly flexible when it comes to payments. They have several options available. You might be able to set up a short-term payment plan (up to 180 days) or a long-term installment agreement to pay off the debt in manageable monthly chunks. For those in serious financial hardship, an "Offer in Compromise" (OIC) might be an option, which allows you to settle your tax debt for less than the full amount owed.

The key is to be proactive. Once the IRS processes your returns and sends you a bill, respond to it. Call them. Explain your situation. They have programs designed to help people who want to get right but don't have the means to pay all at once. Ignoring the bill is what leads to more severe collection actions. Communication is everything.

The Light at the End of the Tunnel

Facing this task head-on is an act of self-care. It’s about quieting that persistent hum of anxiety and reclaiming a part of your life that has been held hostage by fear. Imagine the feeling of finally sending in those returns, knowing that you've dealt with it. Imagine the relief of not having to worry every time you see an official-looking envelope in the mail.

Whether you end up owing money or discovering a long-lost refund, the result is clarity. You’ll know where you stand, and you’ll have a plan. The unknown is always scarier than the reality, and the reality of filing back taxes is that it's a process. A manageable, step-by-step process that you are more than capable of handling.

You don't have to let this define your financial life any longer. Take that first small step today. Download a form, look up a phone number for a tax pro, or just read a little more on the IRS website. You’ll be surprised at how much lighter you feel, just by starting.

You might also like

Unraveling the Mystery: How Personal Injury Claims Are Valued

Ever wondered how a personal injury claim is actually calculated? It's not as simple as adding up bills, and honestly, it can feel like a real puzzle. Let's break down the factors that go into determining what your claim might truly be worth.

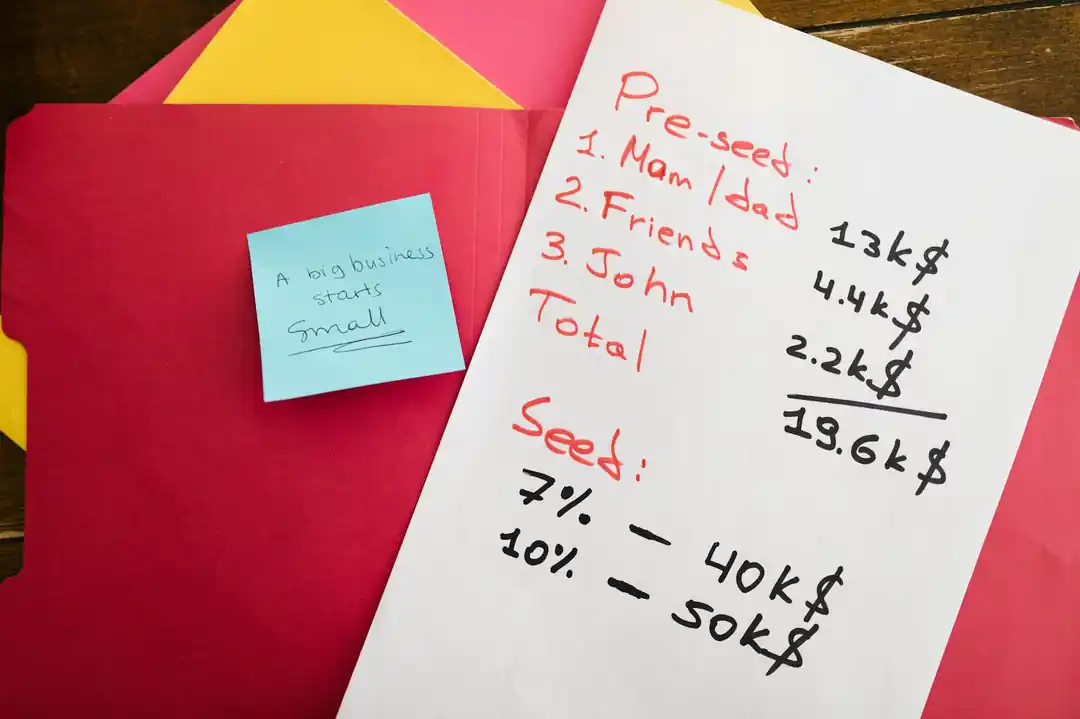

The Entrepreneur's Roadmap to Funding: From a Napkin Sketch to a Billion-Dollar Valuation

Ever wonder how startups go from a simple idea to ringing the bell at the stock exchange? It's a long, winding road paved with different stages of funding. Let's walk through it together.

Your Guide to Renting a Car and Driving in the UAE

Thinking of exploring the Emirates on four wheels? From Dubai's superhighways to desert backroads, here’s what every American traveler needs to know before getting behind the wheel in the UAE.

From Handshake to High-Growth: Decoding the Key Legal Documents in a Seed Round

Raising your first seed round is a landmark moment. But what about the mountain of paperwork? We're breaking down the essential legal documents, from term sheets to voting agreements, to help you navigate the process with confidence.

Is the America the Beautiful Pass Worth It for Your Family? A Deep Dive

Thinking about visiting a few national parks this year? Let's break down the numbers and the real-world value of the America the Beautiful pass for family adventures.