How to Build a Diversified Investment Portfolio From Scratch

Diving into the world of investing can feel overwhelming. Let's break down the mystery and walk through how to build a strong, diversified portfolio, even if you're starting with nothing but a desire to grow your wealth.

Let’s be honest for a second. The world of investing can feel like an exclusive club with a secret handshake. You hear terms like "asset allocation," "ETFs," and "diversification," and it’s easy to feel like you’re already five steps behind. I remember feeling that exact same way. My first brush with investing involved a well-meaning relative telling me to "just buy some stocks." It sounded simple enough, but which ones? How many? And what on earth was I supposed to do after I bought them? It was paralyzing.

The truth is, building wealth through investing isn't about having a crystal ball or some innate genius for the market. It's about discipline, patience, and a solid strategy. And the cornerstone of a solid strategy, especially when you're building from the ground up, is diversification. It’s a concept that’s both incredibly simple and profoundly powerful. It’s the financial equivalent of not putting all your eggs in one basket, and it’s the single best way to protect yourself from the market's inevitable mood swings while setting yourself up for long-term success.

What is Diversification and Why Does It Matter?

At its heart, diversification is the practice of spreading your investments across various financial instruments, industries, and geographical areas. The goal is to minimize the impact that any single asset's poor performance can have on your overall portfolio. Think about it: if you invested all your savings into a single company and that company unexpectedly goes under, you could lose everything. But if your money is spread across hundreds or even thousands of companies, the failure of one is just a tiny blip, not a catastrophe.

This isn't just a defensive move; it's a strategy for smoother, more predictable growth. Different asset classes often move in different cycles. For example, when the stock market (equities) is struggling, high-quality bonds often hold their value or even increase. By owning a mix of both, you create a more stable foundation. I recently read a report from Vanguard that emphasized how a diversified portfolio can help investors "navigate the ups and downs of the market" without making rash, emotional decisions. That really resonated with me. It’s not about avoiding risk entirely—that’s impossible—but about managing it intelligently so you can stay invested for the long haul.

The beauty of this approach is that it removes the pressure to be a perfect stock-picker. Instead of trying to find the one-in-a-million "next big thing," you're essentially betting on the long-term growth of the entire economy. It’s a shift in mindset from gambling to strategic planning. And for someone just starting out, that shift is everything. It provides the confidence to get in the game and stay in it.

The Core Building Blocks of Your Portfolio

So, what do you actually buy to be diversified? A well-rounded portfolio is typically built on a foundation of a few key asset classes. The main players you'll want to get familiar with are stocks and bonds.

Stocks (Equities): When you buy a stock, you're buying a small piece of ownership in a public company. Historically, stocks have offered the highest long-term growth potential, but they also come with the most volatility. To diversify within stocks, you shouldn't just buy a few companies you've heard of. You should aim for a mix of company sizes (large-cap, mid-cap, and small-cap), industries (technology, healthcare, consumer goods, etc.), and geographic locations (U.S. and international).

Bonds (Fixed Income): Bonds are essentially loans you make to a government or a corporation in exchange for regular interest payments. They are generally considered safer than stocks and can provide a steady stream of income and stability to your portfolio. When stocks go down, bonds often act as a cushion.

For a beginner, buying individual stocks and bonds to achieve proper diversification is a monumental task. This is where mutual funds and exchange-traded funds (ETFs) become your best friends. These are funds that pool money from many investors to purchase a broad collection of stocks or bonds. For instance, an S&P 500 index fund ETF gives you a piece of the 500 largest companies in the U.S. with a single purchase. It's instant diversification, and it's incredibly cost-effective.

A Simple Blueprint for Your First Portfolio

Ready to get practical? Building your first portfolio can be broken down into a few manageable steps.

First, you need to decide on your asset allocation. This is just the fancy term for deciding what percentage of your money goes into stocks versus bonds. This decision depends heavily on your age, your financial goals, and your personal risk tolerance. A common rule of thumb is the "60/40 portfolio" (60% stocks, 40% bonds), which is considered a balanced approach. However, if you're young and have a long time until retirement, you can likely afford to take on more risk for more potential growth, so you might opt for an 80/20 or even 90/10 split.

Once you have a target allocation, you can build a simple, three-fund portfolio using low-cost index fund ETFs. This is a popular strategy for a reason—it's simple, effective, and incredibly diversified. A classic three-fund portfolio might look something like this:

- A U.S. Total Stock Market Index Fund: This gives you exposure to thousands of U.S. companies, big and small.

- An International Total Stock Market Index Fund: This diversifies your stock holdings across developed and emerging markets outside the U.S.

- A U.S. Total Bond Market Index Fund: This provides the stability of a broad range of U.S. investment-grade bonds.

You would then buy these three funds in proportions that match your desired asset allocation. For example, in an 80/20 portfolio, you might put 50% in the U.S. stock fund, 30% in the international stock fund, and the remaining 20% in the bond fund. You can do all of this through a brokerage account from providers like Vanguard, Fidelity, or Charles Schwab, many of which offer commission-free trading on their own ETFs.

Putting It All Together and Staying the Course

The final piece of the puzzle is execution and maintenance. The first step is to open an investment account. If you're saving for retirement, a tax-advantaged account like a Roth IRA is an amazing place to start. If you're saving for other goals, a standard brokerage account will work perfectly.

Once your account is open and funded, you can purchase your chosen ETFs. And then... you wait. The hardest part of investing for many people is fighting the urge to constantly tinker. Your portfolio will go up and down. That is normal. The key is to stay disciplined. Continue to contribute money regularly (a practice known as dollar-cost averaging) and try to rebalance your portfolio about once a year. Rebalancing simply means selling a bit of what has done well and buying more of what has lagged to get back to your target asset allocation.

Building a diversified portfolio from scratch is one of the most empowering steps you can take for your financial well-being. It demystifies the world of investing and puts you in the driver's seat. It’s not about getting rich quick; it’s about building a secure and prosperous future, one thoughtful investment at a time. Here’s to your journey.

You might also like

More Than Just Hitting Record: A Beginner's Guide to Cinematic Storytelling

Ever wonder how your favorite films look so beautiful? It's all about cinematography. Let's dive into the basic principles that turn a simple video into a visual story.

Hollywood's Sweat Secrets: What Fitness Trends Actually Work?

Ever wonder how celebrities get that red-carpet-ready look? We're diving deep into the most popular Hollywood fitness trends, from Pilates to Zone 2 training, to see what's effective and what's just hype.

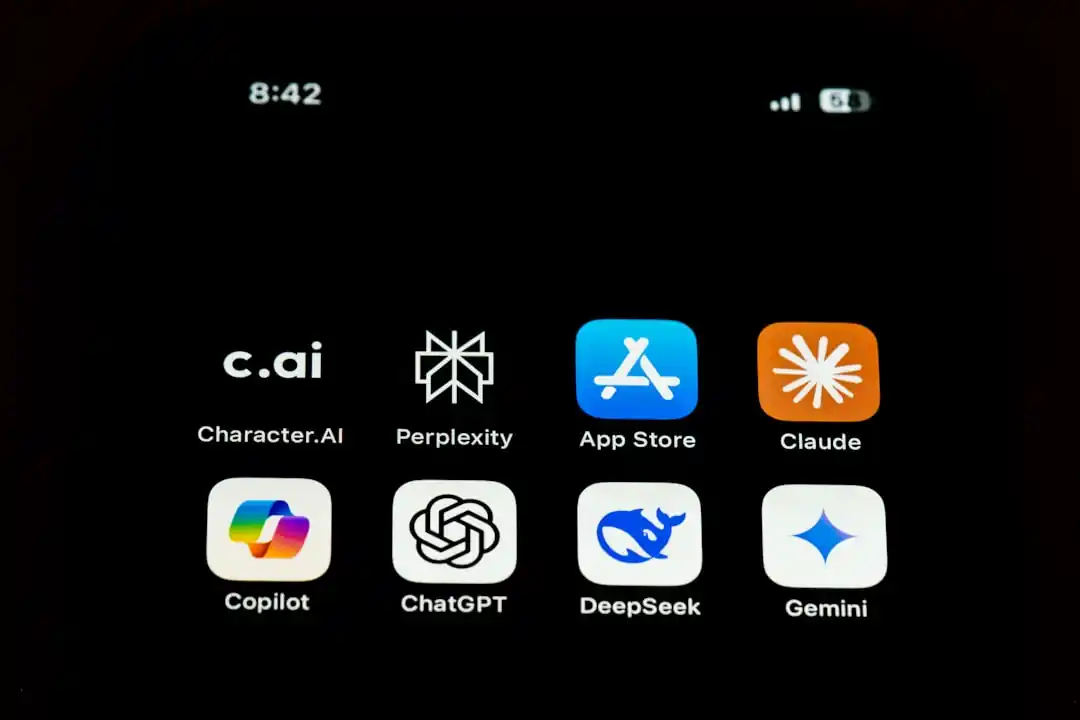

Your Phone's Getting Smarter: Why On-Device AI Is a Game-Changer

Ever wonder how your phone got so fast and intuitive? It's not magic, it's on-device AI. Let's explore why having a brain in your pocket is better than the cloud.

The Creator's Dilemma: What's the Best Video Editor for Social Media?

Feeling lost in the sea of video editing software? Let's cut through the noise and find the perfect tool to make your social media content truly shine.

Minsk Airport to City Center: Your Stress-Free 2026 Travel Guide

Just landed in Minsk and wondering how to get to the city? I've broken down all the transportation options from the airport to downtown, from budget-friendly buses to comfortable taxis.